The cryptocurrency market is never short of excitement. With new projects launching regularly and existing coins experiencing volatility, traders and investors are constantly seeking opportunities. One project that has piqued the interest of many is Beam (BEAM). In this blog post, we will perform a comprehensive technical analysis of Beam’s price chart, discuss support and resistance levels, interpret key indicators, and explore potential scenarios for Beam to make new all-time highs. We will also briefly examine the probability and scenario in which Chainlink (LINK) could reach new all-time highs. By the end of this post, you will have a clear understanding of Beam’s current market structure, price action, and what to look for going forward.

Understanding Beam: Project Overview

Beam is a privacy-focused cryptocurrency designed to offer confidential and secure transactions. It utilizes the Mimblewimble protocol, aiming to provide robust privacy features while maintaining a scalable blockchain network. Over time, Beam has garnered attention for its strong cryptographic foundations and the team’s commitment to continuous development.

Here are some key points about Beam’s on-chain metrics and tokenomics (as of the latest data provided):

- Price: $0.009204 (up 5.20% in the last 24 hours)

- Market Cap: $455,302,094 (CoinMarketCap ranking #117)

- 24-Hour Trading Volume: $82,068,852

- Circulating Supply: 49,466,004,168 BEAM

- Total Supply: 62.43B BEAM

- Holders: 71.48K addresses

- Whale Holdings: ~64.79% of total supply held by whales

- Addresses by Time Held:

- Cruisers (1–12 months): 57.15%

- Traders (<1 month): 6.00%

- Holders (>12 months): 36.85%

These figures paint a picture of a cryptocurrency with a fairly large holder base and significant whale ownership. Whales controlling over half of the supply can introduce volatility or price stability, depending on their trading activity.

Technical Analysis Overview

Beam’s price at the time of writing stands around $0.0092, showing a 5.20% increase over the past 24 hours. The daily trading volume is notably high at over $80 million, suggesting healthy liquidity and trader interest.

Since the beginning of the year, Beam’s price has experienced several fluctuations. It reached a local peak in late 2022 before entering a prolonged downtrend that continued into early 2023. In recent weeks, however, the price appears to be stabilizing around a crucial support zone, indicating a potential shift in momentum.

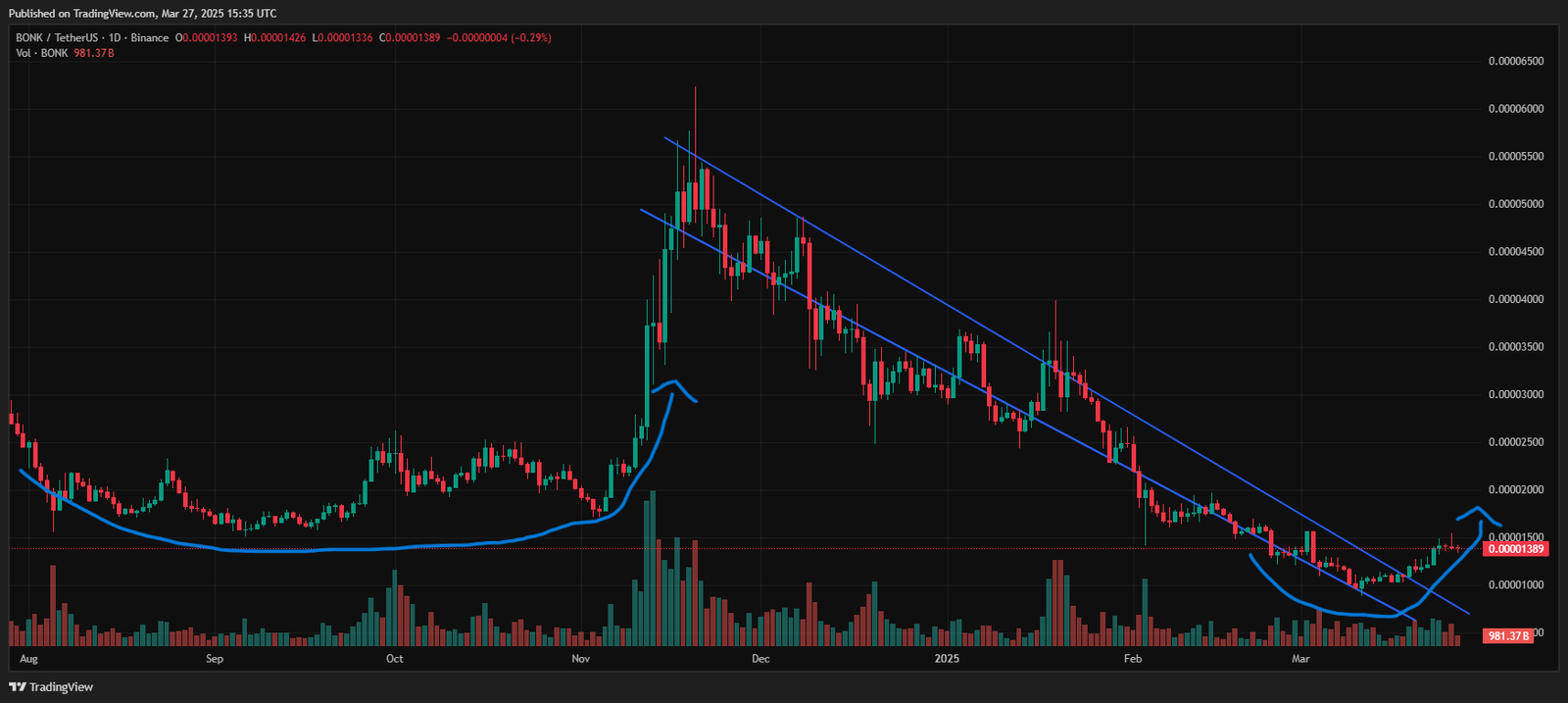

Downtrend Channels and Bollinger Bands

A notable feature on the chart is the presence of descending channel lines drawn from the previous local highs. These lines reflect the general downtrend Beam has been experiencing for several months. However, in the past few weeks, the price has begun to challenge these descending trendlines, suggesting that the downtrend could be weakening.

Bollinger Bands are also plotted on the chart, with a middle moving average line and upper/lower bands that widen or tighten based on volatility. Recently, the Bollinger Bands appear to have been narrowing, reflecting reduced volatility and a potential “squeeze.”

A Bollinger Band squeeze often precedes a significant price move, either to the upside or the downside. The price pushing above the middle band can be an early signal of bullish momentum, while a drop below the lower band can reinforce a bearish trend.

Key Support and Resistance Levels

Identifying support and resistance levels is crucial for understanding potential turning points in price action. Below are the major levels to watch:

Support Levels

- $0.0085 – $0.0080 Zone

- This zone has acted as a local support in recent weeks. It coincides with the lower boundary of the Bollinger Bands on the daily timeframe and has been tested multiple times without a decisive breakdown.

- If the price dips into this area, buyers may step in, expecting a short-term bounce.

- $0.0070 – $0.0065 Zone

- In the event of a stronger market sell-off, Beam could retest this deeper support region. This zone corresponds to a previous consolidation range and could be a point where long-term holders add to their positions.

- A decisive break below this level would signal increased bearish sentiment, potentially leading to further downside.

Resistance Levels

- $0.010 – $0.011 Zone

- This psychological zone has historically served as both support and resistance. It also aligns with the middle Bollinger Band and the descending channel’s midline. Breaking above $0.011 could signal a shift in market structure and an attempt to establish a new uptrend.

- $0.013 – $0.015 Zone

- A significant pivot area from previous price swings. If Beam’s price rallies past $0.011 and sustains momentum, traders will likely target this zone. A break above $0.015 would increase the probability of a stronger bullish move.

- $0.018 – $0.020 Zone

- This region has historical significance and could serve as the next major barrier after $0.015. Breaching $0.020 would be a strong bullish signal, potentially drawing in momentum traders and FOMO (fear of missing out) buyers.

Indicators on the Chart and Their Meaning

Many traders use Simple Moving Averages (SMAs) or Exponential Moving Averages (EMAs) to gauge the market’s trend. On the chart, it appears we have a 50-day Simple Moving Average and a 100-day Simple Moving Average (though the user’s data references may vary).

- 50-Day SMA: Often used to track short- to mid-term trends. When the price trades above this SMA, it can suggest bullish momentum. Conversely, trading below it indicates a bearish phase.

- 100-Day SMA: Provides a broader view of the market’s trend. A crossover where the 50-day SMA rises above the 100-day SMA is typically a bullish signal, known as a Golden Cross. If the 50-day SMA moves below the 100-day SMA, it is considered a Death Cross and can indicate a continuation of the downtrend.

Currently, Beam’s price appears to be near or below its short-term moving averages, reflecting the lingering bearish pressure. A decisive move above these moving averages would be one of the early signs that Beam is shifting to a more bullish structure.

Bollinger Bands

As mentioned, Bollinger Bands measure volatility by plotting a moving average and two standard deviations above and below that average. Key observations include:

- Narrowing Bands: Suggest reduced volatility and a potential squeeze. This often precedes a breakout, although the direction is not always certain.

- Price at the Lower Band: Indicates a potential oversold condition. If the price respects the lower band and bounces, it may lead to a short-term reversal to the middle or upper band.

- Price at the Upper Band: Can signal an overbought condition. If price continually hugs the upper band without a significant pullback, it is often a sign of strong bullish momentum.

Given the recent narrowing of the Bollinger Bands on Beam’s chart, traders should remain vigilant for a breakout. If Beam’s price closes firmly above the middle band, it could be the first indication of a bullish reversal.

Trading Volume

Volume is crucial in confirming the validity of price movements. A price increase accompanied by rising volume generally indicates strong buyer interest, whereas a price drop on high volume can reflect robust selling pressure.

- High 24-Hour Trading Volume ($82M+): Indicates active participation by market participants. Such high volume can lead to more pronounced moves in either direction.

- Volume Spikes at Support Levels: If Beam tests a support level (e.g., $0.0085) on higher-than-average volume and bounces, it suggests that buyers are defending that level.

Price Prediction Going Forward

Bullish Scenario

In a bullish scenario, Beam manages to hold above the $0.0085 support level and breaks out of its descending channel. Here’s how it might play out:

- Initial Breakout: The price closes above $0.010, marking the first major bullish signal. Volume increases, and Beam sustains its momentum over a few days.

- Challenge Higher Resistance: The price moves toward the $0.013–$0.015 zone. If Beam breaks through $0.015 on strong volume, it could trigger a new wave of buyers.

- Momentum Toward $0.018–$0.020: Beam tests the next significant resistance. A decisive break above $0.020 would be a powerful signal that the market is turning bullish.

- New All-Time Highs?: While new all-time highs require a strong and sustained bull market environment, surpassing these key resistance zones would put Beam in a position to aim for its previous historical peaks and potentially beyond.

Bearish Scenario

On the other hand, if Beam fails to hold the $0.0085 support and continues its descent:

- Support Breakdown: Beam slips below $0.0080, indicating weak buying interest. This could open the door for a retest of deeper support around $0.0070–$0.0065.

- Prolonged Downtrend: With a lack of bullish catalysts, the price could remain in a downward spiral, especially if broader market sentiment turns negative.

- Sideways Consolidation: Beam might then consolidate at lower levels for an extended period, waiting for a fundamental or macro catalyst to reignite buying interest.

Factors Influencing Beam’s Path to New All-Time Highs

Market Sentiment

The crypto market is often driven by sentiment, with fear or greed amplifying price movements. If the broader market sentiment becomes extremely bullish, capital inflows could lift all coins, including Beam. Conversely, a market-wide downturn could overshadow even the strongest fundamental developments.

Whale Activity

Since whales control around 64.79% of Beam’s circulating supply, their actions can significantly impact price direction. If whales decide to accumulate more or hold for the long term, the price could stabilize and gradually move upwards. Conversely, if a few large holders decide to sell off their positions, it could lead to sharp downward movements.

Development and Partnerships

Beam’s ongoing development and any high-profile partnerships could boost investor confidence. Regular updates from the Beam team, new use cases, or major exchange listings can act as catalysts for price appreciation.

Regulatory Environment

As Beam is a privacy-centric project, regulatory scrutiny may intensify around privacy-focused coins. Future regulations could influence the project’s adoption and exchange listings, thereby affecting price action.

Strategies for Traders and Investors

Dollar-Cost Averaging (DCA)

For those with a long-term bullish outlook on Beam, dollar-cost averaging can help mitigate the effects of volatility. By regularly purchasing small amounts over time, you spread out your entry points and reduce the risk of buying a local top.

Swing Trading

If you prefer a more active approach, swing trading around key support and resistance levels may be an option. Look for price action confirmations, such as bullish engulfing candlesticks at support or breakouts above resistance with high volume.

Stop-Loss and Risk Management

Regardless of your strategy, employing stop-loss orders and maintaining sound risk management is crucial in the volatile crypto market. Define your risk tolerance and adjust your position sizes accordingly.

Beam’s price action over the past few months has been characterized by a steady downtrend, but recent signs—such as price stabilization near $0.0085 and narrowing Bollinger Bands—suggest a possible shift in momentum. Breaking above $0.010–$0.011 with strong volume would be the first step in reversing the downtrend and targeting higher resistance levels at $0.013–$0.015 and eventually $0.018–$0.020.

Final Words

Beam’s journey to new all-time highs will depend on multiple factors, including breaking through key resistance zones, maintaining healthy trading volume, and benefiting from broader market tailwinds. While it’s impossible to predict exact price targets with certainty, paying close attention to the technical signals—such as support/resistance, moving averages, Bollinger Bands, and volume—can help you make informed decisions.

For long-term believers in Beam’s privacy-focused vision, current prices could present an attractive entry point if you anticipate a broader market upswing or bullish project developments. Meanwhile, traders might look for confirmation of a breakout above $0.010 to capitalize on potential short-term momentum.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial or investment advice. Always conduct your own research or consult a qualified professional before making any investment decisions.