In a surprising twist that has electrified the crypto market, major digital assets ADA, XRP, and Solana have experienced a robust rally, climbing sharply after former President Donald Trump stated that these coins would be included in the new US Crypto Reserve. This bold political statement has sent shockwaves throughout the cryptocurrency ecosystem, sparking debates among investors, regulators, and market analysts about the future role of digital assets in national financial strategy.

This comprehensive analysis examines the short- and long-term effects of Trump’s remark on these cryptocurrencies. We dive deep into macroeconomic and microeconomic factors, the regulatory and political climate, and even seasonal market trends to understand what this means for ADA, XRP, and Solana moving forward. Whether you’re a seasoned crypto investor or new to the space, the insights provided here aim to equip you with the knowledge needed to navigate this dynamic market environment.

Overview of the Headline

Over the past few days, the cryptocurrency market has been abuzz with positive sentiment as ADA (Cardano), XRP (Ripple), and Solana surged significantly. The rally followed a high-profile announcement from former President Donald Trump, who asserted that certain coins—specifically ADA, XRP, and Solana—would be included in the forthcoming US Crypto Reserve. This statement has not only driven up the prices of these coins but also ignited a wave of optimism and speculation about the potential institutional backing and legitimization of digital assets.

The headline “ADA, XRP and Solana Rip Higher After Trump Says Coins Will Be Included in US Crypto Reserve” encapsulates the market’s excitement. In a time when regulatory uncertainty and macroeconomic challenges often cloud the crypto market, such a statement from a prominent political figure can significantly shift investor sentiment.

Context and Significance

This news is especially noteworthy given the current backdrop of volatility in global markets and the ongoing debates about how digital currencies should be integrated into traditional financial systems. Trump’s announcement comes at a time when cryptocurrencies are gradually being recognized as a viable asset class by institutional investors and policymakers alike. The prospect of a US Crypto Reserve, which could serve as a cornerstone of national digital finance strategy, represents a major turning point that could pave the way for broader adoption of digital assets.

The potential inclusion of ADA, XRP, and Solana in a US Crypto Reserve suggests that these coins might receive enhanced institutional support and regulatory clarity. This move could drive a revaluation of these assets, boosting investor confidence and influencing market trends far beyond their immediate price action.

Understanding the US Crypto Reserve Concept

Before delving into the recent price action, it is important to understand what a US Crypto Reserve entails. A US Crypto Reserve is envisioned as a repository of selected cryptocurrencies that could be held by the government as part of its financial strategy. This reserve would serve several purposes:

- Stabilizing the Financial System: By holding a diversified portfolio of digital assets, the government could potentially stabilize the financial system in times of market turbulence.

- Institutional Adoption: The reserve could pave the way for wider institutional adoption by providing a regulated and secure framework for holding digital assets.

- Monetary Policy Tool: Similar to traditional reserves like gold, a crypto reserve could be used as a tool in the execution of monetary policy, offering an alternative asset class that is less correlated with traditional financial instruments.

The inclusion of cryptocurrencies like ADA, XRP, and Solana in such a reserve could dramatically enhance their legitimacy and market standing, potentially unlocking new avenues for growth and investment.

Overview of Trump’s Statement

In a series of interviews and public statements, former President Donald Trump made headlines by suggesting that the US government is considering including certain cryptocurrencies in the national crypto reserve. Key points from Trump’s announcement include:

- Selective Inclusion: Trump indicated that not all cryptocurrencies would qualify; instead, coins with strong technological foundations and widespread adoption, such as ADA, XRP, and Solana, were being considered.

- Regulatory Framework: The statement implied that this inclusion would come as part of a broader effort to integrate digital assets into the existing financial system, potentially leading to a more regulated and stable market.

- Media Reaction: The media coverage was extensive, with headlines praising the potential boost to these coins, while skeptics questioned the feasibility and long-term implications of such a move.

The initial market reaction was overwhelmingly positive, as investors interpreted the news as a major institutional endorsement of these digital assets.

Market Reaction and Price Action

ADA (Cardano)

- Recent Performance: ADA has experienced a notable price increase in the wake of Trump’s announcement. Trading volumes have surged, and the coin’s market capitalization has expanded significantly.

- Percentage Increase: Over the past 24 to 48 hours, ADA’s price has risen by approximately 60-65% as of time of publishing, with a marked increase in investor activity.

- Historical Comparison: When compared to previous rallies, this recent surge is one of the most substantial in recent months, indicating a strong bullish sentiment.

XRP (Ripple)

- Recent Performance: XRP, a coin often at the center of regulatory debates, has shown remarkable resilience. Following the announcement, XRP’s price surged more than 25%, reflecting renewed investor confidence.

- Volume and Volatility: XRP has experienced a spike in trading volumes, and its price volatility has increased as market participants take advantage of the rally.

- Market Position: Given its history and the regulatory challenges it has faced, XRP’s sharp rise is particularly noteworthy and suggests that investors may be optimistic about its long-term prospects.

Solana (SOL)

- Recent Performance: Solana, known for its high-speed and low-cost blockchain, has also rallied strongly. Its price has seen significant gains, bolstered by both technical momentum and positive sentiment from the crypto community.

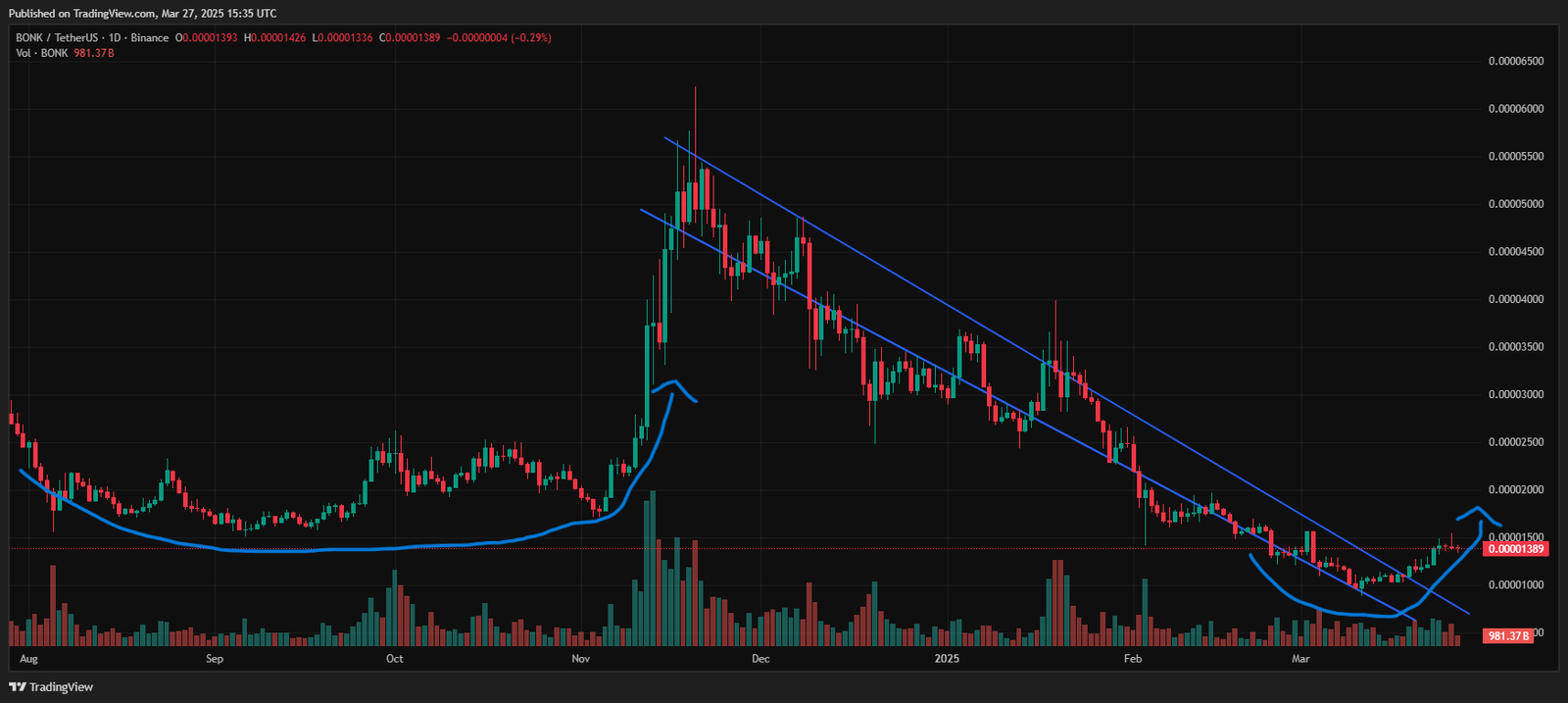

- Technical Indicators: Solana’s recent technical indicators, including support levels and moving averages, suggest that the rally could be sustained if current trends continue.

- Volume Spikes: Increased trading volume and liquidity have further supported Solana’s recent price action, making it one of the top performers in the current rally.

What to expect from these coins going forward

Market Validation and Institutional Confidence

If XRP, ADA, and SOL are incorporated into the US Crypto Reserve, it would serve as a strong institutional endorsement. Such recognition could boost investor confidence, as the government’s backing would signal that these assets meet certain standards of stability and utility. This could drive increased demand from both retail and institutional investors, leading to upward pressure on prices.

Improved Liquidity and Trading Volumes

Being part of an official reserve would likely enhance liquidity across major exchanges. With higher liquidity, these coins could experience smoother price action, reducing the dramatic volatility often seen in the crypto market. Increased trading volumes and deeper order books would support more efficient price discovery, potentially stabilizing long-term value.

Regulatory Clarity and Long-Term Growth

Inclusion in a US Crypto Reserve would probably come with a more defined regulatory framework. Clearer guidelines would reduce uncertainty—a key factor in market hesitance—thereby creating a more secure investment environment. As regulatory clarity improves, long-term growth prospects for XRP, ADA, and SOL could be enhanced, encouraging further technological innovation and broader adoption.

Ecosystem Expansion and Technological Advancements

Institutional backing could catalyze additional partnerships and technological upgrades within the ecosystems of these coins. Enhanced network development, increased utility in decentralized applications, and integration into mainstream financial services might follow. This, in turn, could create a virtuous cycle of adoption and value appreciation.

Short-Term Volatility and Market Corrections

Despite these positive prospects, the initial market reaction could be highly volatile. The announcement might trigger a wave of speculative trading as investors reposition their portfolios. Short-term price fluctuations could be pronounced if large holders (whales) decide to offload or rapidly accumulate positions, potentially leading to temporary corrections.

Overall Outlook

In the long run, if XRP, ADA, and SOL are included in the US Crypto Reserve, their outlook appears promising. Institutional validation, improved liquidity, regulatory clarity, and expanded ecosystem applications all point toward potential long-term growth. However, investors should remain cautious, keeping an eye on short-term volatility and any evolving regulatory or political changes that might impact the market.

This balanced perspective underscores the potential for significant positive change, while also highlighting the inherent risks associated with such transformative policy shifts in a dynamic market environment.

Investor Sentiment and Social Media Buzz

The reaction from investors and the crypto community has been a critical factor in driving the recent rally. An analysis of social media platforms such as Twitter (now X.com) and Reddit reveals several key trends:

Community Response

- Positive Sentiment: Influential crypto personalities and analysts have taken to social media to express optimism about the potential impact of Trump’s statement. Hashtags related to ADA, XRP, and Solana have trended, indicating a surge in positive sentiment.

- Influencer Endorsements: Prominent influencers in the crypto space have amplified the news, leading to increased trading activity and a general sense of bullishness across the market.

- Discussion Forums: Online communities have engaged in vigorous discussions about the implications of a US Crypto Reserve, with many speculating that this could be the beginning of a new era for digital assets.

Media Coverage

- News Outlets: Mainstream media and specialized crypto news sites have covered the story extensively. This broad coverage has helped to validate the news and attract a wider range of investors.

- Analyst Reports: Several analyst reports have highlighted the potential long-term benefits of integrating digital assets into national reserves, further driving investor confidence.

Macroeconomic Factors

A. Global Economic Climate

The broader economic environment plays a pivotal role in shaping investor behavior. Several macroeconomic factors are influencing the current market dynamics:

Rising Inflation and Interest Rates

- Inflation Trends: Global inflation rates have been on an upward trajectory, prompting central banks to tighten monetary policy. This environment has led many investors to seek alternative assets that can hedge against inflation, with cryptocurrencies increasingly viewed as a potential safe haven.

- Interest Rate Hikes: As central banks raise interest rates to combat inflation, traditional savings and bond markets become more attractive. However, this dynamic also drives speculative capital toward high-risk, high-reward assets like cryptocurrencies, especially when accompanied by positive news.

Global Market Uncertainty

- Economic Slowdown: Signs of economic slowdown in major economies have contributed to increased market volatility. Investors are rebalancing their portfolios to mitigate risk, which can lead to rapid price swings in volatile assets like ADA, XRP, and Solana.

- Safe-Haven Demand: During periods of uncertainty, some investors turn to cryptocurrencies as an alternative to traditional safe-haven assets like gold. The current political and economic landscape has created a unique situation where digital assets are increasingly seen as a diversification tool.

Political Climate and Regulatory Policies

Political developments and regulatory policies are also shaping market sentiment:

US and International Regulatory Trends

- Regulatory Developments: Recent announcements and discussions about a US Crypto Reserve have signaled a shift toward more formal integration of digital assets into the financial system. This could lead to clearer regulatory guidelines and increased institutional participation.

- Global Comparisons: While the US debates digital asset regulation, other regions like Europe and Asia have also been actively developing their regulatory frameworks. These developments collectively contribute to a more mature global crypto market, albeit with regional variations in policy.

Political Statements and Their Impact

- Trump’s Remark: Former President Trump’s statement about including coins in the US Crypto Reserve is a prime example of how political rhetoric can have immediate and profound effects on market sentiment. This remark has not only boosted prices but also attracted attention from a broader investor base.

- Policy Uncertainty: Despite the positive market reaction, there remains an element of uncertainty regarding the long-term implications of such political statements. Future policy decisions could either bolster this positive sentiment or introduce new regulatory challenges.

Broader Market Trends and Crypto Seasonalities

Crypto markets are known for their cyclical nature, influenced by seasonal factors and broader asset trends:

Seasonal Patterns

- Market Cycles: Historically, the crypto market has exhibited distinct bull and bear cycles. Seasonal factors such as year-end tax selling and portfolio rebalancing can lead to periods of increased volatility.

- Current Cycle Analysis: The current rally in ADA, XRP, and Solana might be part of a broader cyclical rebound following a prolonged period of consolidation and decline.

Comparative Analysis with Other Assets

- Asset Class Correlations: Trends in traditional asset classes such as stocks, gold, and bonds often influence investor behavior in the crypto market. For instance, if traditional markets are experiencing a recovery, it may lead to increased risk appetite and, consequently, a further rally in digital assets.

- Macro Trends: Broader economic trends, such as geopolitical tensions and shifts in fiscal policy, can also impact market cycles, creating opportunities or challenges for speculative assets.

Micro-Economic Factors

Liquidity and trading volume are crucial metrics that indicate the health and stability of the market:

Recent Volume Trends

- Volume Spikes: Data from CoinMarketCap and similar platforms show a significant increase in trading volumes for ADA, XRP, and Solana following Trump’s announcement. This surge suggests strong buying interest and higher market participation.

- Liquidity Impact: Enhanced liquidity generally supports price stability by reducing volatility. However, in the current environment, increased volume has also led to more pronounced price swings, as both retail and institutional investors react quickly to market news.

Comparative Analysis with Historical Data

- Volume Comparisons: By comparing current trading volumes with historical data, we can assess whether the recent rally is backed by sustainable liquidity. Initial indicators suggest that the current surge is among the highest in recent months, pointing to a strong, albeit potentially temporary, influx of capital.

- Market Depth: Analyzing order book data reveals increased market depth, meaning that there are more buy and sell orders at various price levels, which can help absorb large trades and prevent extreme price movements.

Holder Dynamics and Whale Activities

The distribution of coin holders and the activities of large investors (“whales”) provide insight into the underlying market sentiment:

Changes in Holder Counts

- Increasing Holder Base: Recent blockchain analytics indicate that the number of unique holders for ADA, XRP, and Solana has risen significantly following the rally. This suggests that new investors are entering the market, contributing to a more diversified and stable holder base.

- Distribution Analysis: A well-distributed holder base, where no single entity controls a large percentage of the supply, is generally a positive sign for long-term stability. Recent data shows a shift toward more small and medium-sized holders, which could support sustained growth.

Whale Activities

- Accumulation Trends: Analysis of on-chain data reveals that whales have been actively accumulating ADA, XRP, and Solana. This behavior indicates a level of confidence among large investors, who typically have a more strategic, long-term outlook.

- Potential Risks: While whale accumulation can stabilize prices, sudden large sell-offs by these entities remain a risk. Monitoring whale behavior is critical for anticipating potential market corrections.

Technical Analysis Insights

Technical analysis offers a complementary perspective on market trends, focusing on price action, chart patterns, and key indicators:

Price Action and Chart Patterns

- Support and Resistance Levels: Recent technical charts show that ADA, XRP, and Solana have approached critical support levels that have historically acted as price floors during downturns. Breaking these levels could trigger further selling, while holding above them may signal a consolidation phase.

- Bullish Patterns: Preliminary chart patterns, such as ascending triangles and bullish candlestick formations, suggest that there is underlying momentum in the recent rally. These patterns, if confirmed by further price action, could indicate the start of a longer-term uptrend.

Key Technical Indicators

- Moving Averages: The short-term moving averages (e.g., 50-day) for ADA, XRP, and Solana are trending upward, crossing above their long-term moving averages (e.g., 200-day) in many cases. Such crossovers are traditionally viewed as bullish signals.

- Relative Strength Index (RSI): The RSI values for these coins indicate that while they are not yet overbought, there is strong momentum. A continued upward trend could eventually push the RSI into overbought territory, signaling caution.

- MACD Analysis: The Moving Average Convergence Divergence (MACD) for each coin has recently shown positive momentum, with the MACD line crossing above the signal line—a technical indicator that often precedes further price increases.

Future Outlook and Scenarios

Looking ahead, several factors could drive further growth in ADA, XRP, and Solana, particularly if the broader macroeconomic and regulatory environment remains favorable:

Optimistic Scenario

- Sustained Institutional Interest: Continued inclusion of these coins in the US Crypto Reserve or similar institutional initiatives could drive sustained demand. If regulators provide clear guidelines and foster a supportive environment, institutional investors may pour in more capital.

- Technological Advancements: Ongoing improvements in blockchain technology, scalability, and interoperability could further enhance the utility and adoption of ADA, XRP, and Solana. Strategic partnerships and technological upgrades would serve as catalysts for long-term growth.

- Positive Market Cycles: If the broader cryptocurrency market enters a bullish cycle driven by global economic recovery and increased investor risk appetite, these coins could experience prolonged upward momentum.

Pessimistic Scenario

- Regulatory Backlash: Despite current positive sentiment, any sudden shift in regulatory policies or adverse political developments could lead to market corrections. For example, if additional regulatory measures are imposed, investor confidence might wane, leading to a sharp sell-off.

- Market Volatility: Increased trading volumes and speculative behavior can lead to sudden price corrections. If the current rally is driven primarily by speculative buying rather than fundamental improvements, prices may eventually stagnate or decline.

- Whale Sell-Offs: Although whale accumulation has been observed, any sudden mass sell-offs by large holders could destabilize the market, resulting in a significant correction across ADA, XRP, and Solana.

Key Catalysts to Watch

Several upcoming events and market trends will be critical in determining the future trajectory of these cryptocurrencies:

Regulatory Announcements

- US Crypto Reserve Developments: Any further official confirmation regarding the inclusion of cryptocurrencies in the US Crypto Reserve could serve as a major catalyst for renewed institutional interest.

- Global Regulatory Updates: Monitoring regulatory trends in key markets, such as Europe and Asia, will be essential, as any new rules or clarifications could impact investor sentiment significantly.

Technological and Partnership Milestones

- Project Roadmaps: Updates on upcoming technological enhancements or new partnerships for ADA, XRP, and Solana will be crucial indicators of long-term growth potential.

- Adoption Metrics: Increases in the number of dApps, integrations, or real-world use cases will provide a solid foundation for sustained price appreciation.

Strategic Recommendations for Investors

Given the inherent volatility and the complex interplay of macroeconomic, regulatory, and market-specific factors, investors should consider the following strategies:

Risk Management

- Diversification: Spread your investments across various assets, not only within the cryptocurrency space but also across traditional asset classes to mitigate risk.

- Stop-Loss Strategies: Consider using stop-loss orders to protect your portfolio against sudden market downturns, especially in a volatile environment.

- Regular Monitoring: Stay informed about market trends, regulatory developments, and technological advancements. Being proactive can help you adjust your investment strategy as needed.

Long-Term Positioning

- Fundamental Focus: While technical analysis provides short-term insights, maintaining a focus on the long-term fundamentals of ADA, XRP, and Solana is crucial. Evaluate the intrinsic value, use cases, and growth potential of each project.

- Active Engagement: Participate in community discussions on platforms like Twitter (X.com) and Reddit to stay updated on sentiment and emerging trends. Engaging with the community can also provide early warnings of potential market shifts.

- Patience: Given the cyclical nature of the crypto market, a long-term perspective can help weather short-term volatility. Strategic patience combined with proactive risk management is key to navigating this dynamic environment.

Final Thoughts

The rally in ADA, XRP, and Solana following Trump’s statement is a powerful reminder of how political developments can serve as a catalyst for market movements. While the short-term outlook appears bullish, the long-term future of these digital assets will be determined by a complex interplay of macroeconomic conditions, regulatory clarity, technological advancements, and investor sentiment.

As the US Crypto Reserve concept continues to evolve, it could provide a significant boost to digital assets by legitimizing their role in national financial strategy. However, navigating the inherent volatility of the cryptocurrency market requires a balanced approach—one that considers both the opportunities and risks involved.

For investors, the key is to remain agile, informed, and prepared to adjust strategies as new developments unfold. In a market defined by rapid changes and constant uncertainty, staying ahead of the curve is the best defense against potential downturns and the greatest opportunity for capitalizing on upward trends.

We encourage all readers to keep an eye on regulatory updates, market sentiment, and technical indicators as the landscape continues to evolve. Whether you are a long-term investor or a day trader, the coming months will be critical in determining whether this rally can be sustained or if we will see significant corrections.

References and Further Reading

- TradingView – Crypto Charts and Analysis

- Forbes – Analysis on Institutional Adoption of Cryptocurrencies

- Bloomberg – Insights into the US Crypto Reserve Concept

- The Verge – Reporting on Political Impact on Crypto Markets

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with professional advisors before making any investment decisions.