Chainlink (LINK) has emerged as one of the most respected projects in the cryptocurrency space. As a decentralized oracle network, it plays a vital role in bridging the gap between blockchain technology and real-world data. Today, as the live Chainlink price sits at $15.28 USD with a 24-hour trading volume of $350,770,599 USD, investors and crypto enthusiasts wonder: When will Chainlink reach a new all-time high? This comprehensive analysis explores technical indicators and fundamental factors to provide insights into Chainlink’s future price trajectory. In this post, we merge technical chart analysis with a deep dive into Chainlink’s fundamentals to answer key questions such as: What technical signals suggest a breakout? How do underlying fundamentals support a potential surge?

Overview of Chainlink

Chainlink is much more than a cryptocurrency; it is a decentralized oracle network that provides secure and reliable data to smart contracts. In an ecosystem where blockchain systems often lack access to external data, Chainlink fills this gap by connecting on-chain smart contracts with off-chain resources. This unique role makes Chainlink indispensable for many blockchain applications, including decentralized finance (DeFi), insurance, and supply chain management.

The significance of reaching a new all-time high is multifaceted. For investors, it represents a moment of market confidence and the potential for significant returns. For the broader crypto community, it symbolizes the maturation of blockchain technology and the growing adoption of decentralized solutions. Achieving new price peaks often garners media attention and can lead to increased institutional interest and adoption.

Understanding Chainlink: Background & Fundamentals

Chainlink’s journey began with a vision to solve a critical problem in blockchain technology: the need for reliable external data. Founded by Sergey Nazarov and Steve Ellis, Chainlink launched in 2017 and quickly established itself as a crucial service for smart contracts. Over the years, Chainlink has achieved major milestones such as:

- Strategic Partnerships: Collaborations with leading blockchain projects and enterprises.

- Mainnet Launch: Successfully transitioning from testnet to a fully functional mainnet.

- Ecosystem Expansion: Growing integrations across various DeFi platforms, NFT projects, and more.

The Chainlink token (LINK) has evolved from a utility token to a key component of a robust data service network. Its market evolution has been influenced by both the project’s technological advancements and broader trends in the cryptocurrency market.

Core Technology and Use Cases

Chainlink’s core technology centers on decentralized oracles, which are critical for connecting blockchain networks with real-world data. These oracles provide smart contracts with data inputs such as asset prices, weather conditions, and even election results. This ability to fetch off-chain data is essential for the functionality of many decentralized applications.

Key use cases include:

- Smart Contracts: Ensuring that contract terms can be executed automatically based on reliable external data.

- DeFi Integrations: Enhancing the security and accuracy of price feeds used in decentralized lending, borrowing, and trading.

- Insurance: Enabling parametric insurance products that trigger payouts based on objective data, such as weather events.

- Supply Chain Management: Offering transparent and verifiable data to track goods and ensure authenticity.

Fundamental Strengths

Chainlink’s fundamental strengths are deeply rooted in its strategic partnerships, developer activity, and network growth. Let’s examine these in detail:

Strategic Partnerships

Chainlink has secured numerous partnerships with top-tier blockchain projects and established enterprises. These collaborations enhance its credibility and drive real-world use cases. Such alliances include integrations with leading DeFi platforms, gaming projects, and even traditional financial institutions.

Developer Activity and Network Growth

A vibrant developer community and consistent network growth are strong indicators of a project’s long-term viability. Chainlink continuously innovates, with regular updates and improvements that attract both new and experienced developers. This activity not only fuels technological enhancements but also bolsters investor confidence.

Adoption Metrics and Real-World Use Cases

Adoption is measured by the increasing number of integrations and the expanding list of real-world applications. As more platforms rely on Chainlink for secure data delivery, the demand for LINK tokens naturally increases. This growing adoption is a powerful driver for potential price surges.

Market Environment & Crypto Sentiment

Cryptocurrency markets are influenced by a range of macroeconomic factors. Overall market trends, regulatory developments, and global economic conditions play a significant role in shaping investor sentiment. For example:

- Market Cycles: Cryptocurrencies typically move in cycles. Bull markets often coincide with increased media coverage and heightened investor interest, while bear markets tend to trigger panic selling.

- Investor Sentiment: Positive sentiment can drive prices higher, even if the technical indicators are mixed. Conversely, negative sentiment—often influenced by regulatory concerns—can suppress prices.

- Regulatory News: Global regulatory developments, especially those related to cryptocurrency trading and taxation, can lead to sharp market movements.

Technical Analysis of Chainlink

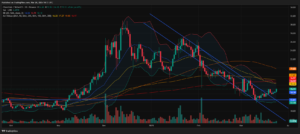

- Descending Channel and Breakout Attempt:

- From late December to late February, Chainlink’s price trended downward within a clear descending channel.

- In early March, the price began to stabilize around the lower boundary of this channel (near the $12–$13 zone) and has since attempted a breakout to the upside.

- Gradual Shift in Momentum:

- The chart suggests that the bearish momentum is weakening.

- After testing multi-week lows, Chainlink has seen a modest recovery, indicating a potential change from a downtrend to a more neutral or slightly bullish trend.

2. Key Support and Resistance Levels

Support Levels

- $14.00–$14.50 Zone (Recent Local Support):

- This area has acted as short-term support on the chart, especially during consolidation in early March.

- If Chainlink fails to hold above $15, traders may look to this zone for a possible bounce.

- $12.00–$13.00 Range (Major Support):

- This region marked the lower boundary of the descending channel and served as a strong support floor during the final leg of the recent downtrend.

- A break below $14 could lead to retesting $13 or slightly lower, where buyers have historically stepped in.

Resistance Levels

- $16.00–$17.00 Range (Short-Term Resistance):

- The upper Bollinger Band and short-term moving averages converge in this region, creating the first notable obstacle for further upside.

- A successful daily close above $16–$17, backed by solid volume, would signal that bulls are regaining control.

- $18.00–$19.00 Range (Confluence with the 200-Day Moving Average):

- The 200-day moving average (often a key long-term trend indicator) appears near $18–$19.

- Historically, breaking and holding above the 200-day MA can shift market sentiment from bearish/neutral to bullish.

- $22.00–$24.00 Zone (Intermediate Resistance):

- This area provided strong resistance in previous uptrends and downtrends.

- Clearing $22–$24 would be a major step, indicating a transition into a more pronounced bullish phase.

- $30.00+ Region (Prior Swing Highs):

- Although not the absolute all-time high for Chainlink, the $30 range has acted as a major pivot in previous market cycles.

- Sustained price action above $30 would be a clear bullish statement and could open the door to testing higher historical levels.

3. Indicators on the Chart

3.1 Bollinger Bands

- Definition: Bollinger Bands measure volatility by plotting two standard deviations above and below a simple moving average (usually the 20-day).

- Current Observation:

- The price recently moved from the lower band toward the middle band.

- If Chainlink breaks above the middle band (and ideally closes above the upper band on higher-than-average volume), it could signal renewed bullish momentum.

- A retreat back to the lower band might indicate continued consolidation or a resumption of the prior downtrend.

3.2 Moving Averages

Most traders watch the 50-day, 100-day, and 200-day simple or exponential moving averages for trend confirmation.

- 50-Day Moving Average (~$15–$16 region):

- The price is attempting to trade above or around the 50-day MA.

- Sustaining a position above this moving average can often signal a short-term bullish shift.

- 100-Day Moving Average (~$16–$17 region):

- The 100-day MA is slightly higher, providing another layer of resistance.

- A break above the 50-day and 100-day in quick succession typically strengthens bullish sentiment.

- 200-Day Moving Average (~$18–$19 region):

- This is a crucial indicator for long-term trend analysis.

- If Chainlink can close multiple daily candles above the 200-day MA, it often marks a transition into a longer-term uptrend.

3.3 Momentum Indicators (Not Shown but Implied)

Even though the chart specifically shows Bollinger Bands and moving averages, traders commonly use momentum indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence):

- RSI (if above 50 and rising): Suggests growing bullish momentum.

- MACD (if near a bullish crossover): Confirms a possible upward shift in trend.

Given the price is recovering from a pronounced downtrend, these momentum indicators, if positive, would support the case for further upside.

4. Price Prediction Outlook

4.1 Short-Term Scenario (Next 1–2 Weeks)

- Neutral to Mildly Bullish:

- The price is trying to break above the descending channel.

- If the price holds above $14 and successfully conquers $16–$17 with decent trading volume, a move toward the 200-day MA ($18–$19) is plausible.

- Failing to hold $14 could bring a retest of $13 or even $12, leading to another consolidation phase.

4.2 Medium-Term Scenario (Next 1–3 Months)

- Bullish Reversal Possible:

- If Chainlink stabilizes above the 200-day MA ($18–$19) and daily closes confirm strength, the market could pivot to a more pronounced uptrend.

- In such a scenario, $22–$24 becomes the next key barrier. Clearing it would likely attract more buyers, potentially pushing LINK toward the upper $20s or even $30.

- Prolonged Consolidation or Sideways Action:

- Should macro market sentiment remain uncertain or if Chainlink fails to hold above critical MAs, the price might oscillate between $14 and $19 for a while.

- This range-bound scenario could persist until a fundamental catalyst or a market-wide bullish turn triggers a decisive breakout.

4.3 Long-Term Probability of a New All-Time High

- Fundamentals + Macro Conditions:

- Chainlink has historically reached higher highs when overall crypto market sentiment is bullish, especially during periods of heavy DeFi activity.

- Given Chainlink’s integral role in supplying reliable data feeds to multiple blockchain ecosystems, it remains well-positioned fundamentally.

- Probability and Timing:

- Probability: While no prediction is guaranteed, the probability of eventually reclaiming and surpassing the all-time high increases if Chainlink maintains a strong fundamental adoption curve (more integrations, partnerships, and network growth) and if the broader crypto market enters another robust bullish phase.

- Timing: A return to previous highs is often a function of market cycles. If Chainlink breaks through the $30 region in a supportive macro environment, a retest of its all-time high—and potentially a new one—becomes increasingly likely. However, this could be months or even a year+ away, depending on market sentiment, macroeconomic factors, and crypto adoption rates.

- Key Catalysts for a New ATH:

- Significant network upgrades or new features (e.g., enhanced staking or major oracle enhancements).

- High-profile partnerships or integrations with enterprise-level clients.

- A strong overall crypto bull market, typically led by Bitcoin and Ethereum momentum.

5. Summary and Takeaways

- Support and Resistance:

- Support: $14 (minor), $12–$13 (major).

- Resistance: $16–$17 (short-term), $18–$19 (200-day MA), $22–$24 (intermediate), and $30+ (long-term pivot).

- Indicators Suggest a Transitioning Trend:

- The price is battling key moving averages and attempting to break out of a descending channel.

- Bollinger Bands show moderate volatility; a move above the middle/upper band could strengthen bullish momentum.

- Next Steps for a Bullish Breakout:

- Sustained closes above $16–$17 and eventually $18–$19 on strong volume.

- Positive momentum signals (e.g., RSI > 50, bullish MACD cross) would reinforce the case.

- Probability of a New All-Time High:

- Fundamentally, Chainlink’s adoption and oracle technology position it favorably for future growth.

- Achieving a new ATH depends on breaking key resistance levels and broader market conditions. A significant bull cycle, supported by Chainlink’s robust utility, could push the price beyond prior peaks.

Fundamental Analysis Deep Dive

On-chain analysis provides a direct view of the blockchain’s activity and can be a powerful tool in assessing Chainlink’s health. Important on-chain metrics include:

- Transaction Volume: The total value of transactions processed on the Chainlink network. Increased volume can indicate heightened usage.

- Active Addresses: A growing number of active addresses often signals increased adoption.

- Staking Metrics: While Chainlink does not use staking in the traditional sense, related network participation metrics can serve as an alternative measure of investor interest.

Partnerships and Ecosystem Growth

Chainlink’s network of partnerships is a cornerstone of its success. The project has integrated with numerous platforms and has ongoing collaborations with leading blockchain entities. Recent and upcoming partnerships have the potential to drive increased demand for LINK:

- DeFi Integrations: Chainlink is widely used across the DeFi landscape, providing reliable data feeds to decentralized applications.

- Enterprise Collaborations: Partnerships with traditional financial institutions and tech companies add to Chainlink’s credibility.

- Expansion into New Markets: As Chainlink explores new sectors, such as insurance and supply chain management, its utility continues to grow.

Development and Roadmap

The Chainlink team is continuously innovating. Regular updates and improvements to the network are critical in maintaining investor trust. Key areas of focus include:

- Scalability: Enhancing network performance to handle higher transaction volumes.

- Security Enhancements: Implementing measures to prevent data tampering and ensure reliability.

- New Oracle Solutions: Expanding the range of data services offered to different blockchain applications.

Institutional Interest & Investment

Institutional interest is a major driver in the cryptocurrency market. In recent times, several reputable financial institutions have shown an increasing interest in blockchain technology and digital assets like Chainlink. Indicators of institutional adoption include:

- Increased Investment: Growing funds and portfolio managers incorporating Chainlink into their strategies.

- Market Sentiment: External endorsements and positive media coverage from influential financial analysts.

- Funding and Partnerships: Strategic collaborations with institutional players help in cementing Chainlink’s role in the financial ecosystem.

Scenarios for a New All-Time High

When forecasting a new all-time high for Chainlink, analysts typically consider both bullish and bearish scenarios.

Bullish Scenario

In a bullish scenario, several factors could converge to drive LINK to new heights:

- Technical Breakout: A decisive breakout above key resistance levels with high trading volume would be a strong signal. If short-term moving averages cross above long-term averages, this could mark the beginning of a new upward trend.

- Major Partnership Announcements: New or enhanced partnerships could drive investor optimism. For example, a high-profile collaboration with a major financial institution or tech giant could attract significant institutional investment.

- Robust On-Chain Activity: Continued growth in active addresses and transaction volume would support higher demand for LINK tokens.

- Positive Market Sentiment: When macroeconomic factors and global crypto sentiment turn favorable, retail and institutional investors alike may flood into the market.

Bearish/Consolidation Scenario

Conversely, several risks could delay or prevent a new all-time high:

- Regulatory Uncertainty: Negative news or regulatory crackdowns could dampen investor enthusiasm and lead to prolonged consolidation.

- Technical Resistance: Persistent technical resistance at key price levels might lead to periods of sideways trading rather than a breakout.

- Market Volatility: Sudden market downturns or external economic shocks could trigger panic selling, thereby delaying a bullish run.

- Internal Project Delays: Any delays or issues in the development roadmap could weaken investor confidence.

Final Words

Chainlink appears to be in the early stages of reversing its recent downtrend, but confirmation is needed above critical resistance levels and moving averages. If momentum and volume continue to favor the bulls—and macro conditions remain conducive—Chainlink could eventually reclaim its all-time high. As always, prudent risk management and ongoing market observation are essential for traders and investors alike.

Disclaimer: This blog post is intended for informational purposes only and does not constitute financial advice. Always consult with a professional advisor before making any investment decisions.