In the ever-evolving landscape of cryptocurrencies, few projects generate as much intrigue as PI Coin. Over the past week, PI Coin has experienced a remarkable upside move, prompting investors, analysts, and community members to ask: What is the future of PI Coin after this strong rally? In this comprehensive analysis, we delve deep into the factors shaping PI Coin’s trajectory—from its fundamentals and recent volume changes to technical chart insights, holder dynamics, whale activities, adoption trends, community sentiment, and the impact of new exchange listings. Using up-to-date data from CoinMarketCap and insights from community sentiment on X.com, we aim to provide a balanced, data-driven forecast that will help investors navigate the next phase of PI Coin’s journey.

Summary of Insights

This comprehensive analysis has examined the future of PI Coin following a strong upside move in the last week. Key findings include:

- Fundamental Strength: PI Coin’s focus on mass adoption, user-centric design, and robust ecosystem development underpins its long-term potential.

- Volume and Liquidity: Increased trading volumes and enhanced liquidity from recent exchange listings support the sustainability of the recent price surge.

- Technical Analysis: Current technical indicators, while bullish in the short term, highlight critical support and resistance levels that must be overcome for sustained growth.

- Holder and Whale Dynamics: An increase in the number of holders and strategic whale activities signal growing investor confidence, though they also carry inherent risks.

- Community and Adoption: Strong community sentiment, as evidenced by active discussions on platforms like X.com, coupled with ongoing adoption milestones, point to a promising future for PI Coin.

- Catalysts and Future Scenarios: Both optimistic and pessimistic scenarios are plausible, depending on upcoming technological, regulatory, and market developments.

Background on PI Coin

PI Coin is an innovative digital asset designed to empower everyday users by democratizing access to blockchain technology. Unlike many cryptocurrencies that target institutional investors or niche sectors, PI Coin’s value proposition centers on mass adoption and inclusivity. The project is built on the idea that every user can participate in the digital economy without needing complex technical knowledge or significant capital investment. This focus on user-centric design has resonated with a wide audience, fueling community growth and adoption.

PI Coin aims to combine simplicity with powerful blockchain features, promising a seamless experience for transactions and interactions on decentralized platforms. Its mission is to create a robust ecosystem where users are incentivized not only to hold the coin but also to use it actively within various applications—ranging from social networking and gaming to decentralized finance (DeFi).

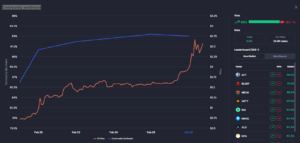

Recap of the Recent Strong Upside Move

Over the last week, PI Coin has seen an impressive surge in price, marking one of its most significant rallies in recent times. According to data on CoinMarketCap, the coin registered an increase of over 20% within a few days, sparking renewed interest among both retail and institutional investors. This rally comes at a time when many digital assets are facing headwinds from macroeconomic pressures, making PI Coin’s performance particularly noteworthy.

The sharp upswing in price was accompanied by a surge in trading volumes and increased activity across multiple exchanges. News outlets and social media platforms, including discussions on X.com, have buzzed with speculation about the catalysts behind this move. Was it driven by a fundamental shift in the project’s outlook, increased adoption, or perhaps strategic moves by large holders (whales)?

Recap of the Recent Upside Move

In the last week, PI Coin’s price experienced a robust upward trajectory. Here are some key points to consider:

- Percentage Increase: The coin saw a jump of approximately 20% over the course of the week, a move that is significant in the context of the typically volatile crypto market.

- Timeline: The surge was concentrated over a few days, with the most dramatic increases occurring in short bursts—a sign of strong market momentum and heightened investor interest.

- Market Cap Impact: As the price climbed, the market capitalization of PI Coin expanded noticeably, reflecting renewed investor confidence and an influx of capital into the project.

Market Reaction

The immediate market response to the upside move was energetic. Key observations include:

- Increased Trading Volumes: Trading volumes spiked on major exchanges, indicating that the rally was supported by genuine trading activity rather than isolated, low-liquidity moves.

- Media Coverage: Crypto news outlets and blogs quickly picked up on the surge, highlighting it as a potential breakout moment for PI Coin.

- Social Media Buzz: On platforms such as X.com, community members, influencers, and traders debated the causes of the rally, sharing technical analyses and bullish sentiment. This grassroots support has helped amplify the momentum.

The convergence of high trading volumes, media attention, and active community discussions suggests that the recent move is more than just a short-term anomaly—it might signal a turning point in PI Coin’s market cycle.

Fundamental Analysis

At its heart, PI Coin is designed to be a user-friendly digital asset that brings blockchain technology to the masses. The coin’s fundamental appeal lies in its focus on inclusivity, ease of use, and potential for widespread adoption. Let’s break down its core strengths:

- User-Centric Design: Unlike many cryptocurrencies that require technical know-how or significant capital to participate, PI Coin is built with simplicity in mind. This design philosophy makes it accessible to a broad audience.

- Decentralized Ecosystem: PI Coin supports a robust ecosystem of applications that range from social networking to decentralized finance. This multi-use functionality ensures that the coin has utility beyond mere speculation.

- Incentive Mechanisms: The project employs various incentive mechanisms that reward users for holding, transacting, and contributing to the network. This not only fosters community engagement but also helps stabilize the coin’s value over time.

Project Developments

Recent developments within the PI Coin ecosystem have further bolstered its prospects:

- Technological Upgrades: The team behind PI Coin has been actively working on enhancing the network’s scalability and security. Recent upgrades have improved transaction speeds and reduced fees, making the platform more competitive.

- Partnership Announcements: In recent weeks, there have been several announcements regarding new partnerships and integrations. These strategic alliances are designed to expand the coin’s utility and reach, potentially driving long-term adoption.

- Community Initiatives: The project has also launched community-driven initiatives aimed at increasing user participation and awareness. These initiatives have been well-received by the community, contributing to a positive feedback loop that supports the coin’s growth.

Ecosystem and Use Cases

PI Coin is not just a speculative asset; it plays a critical role within a broader ecosystem. Some of its key use cases include:

- Decentralized Applications (dApps): PI Coin is integrated into various dApps, ranging from financial services to social platforms, providing a seamless transactional medium within these applications.

- Incentivized Engagement: The project uses its token to reward user participation, thereby driving network effects. As more users join the ecosystem, the coin’s utility and demand are expected to grow.

- Payment Solutions: With its low transaction fees and high-speed processing, PI Coin is positioned as an ideal candidate for microtransactions and digital payments, particularly in markets where traditional banking services are less accessible.

These fundamentals suggest that PI Coin has the potential for sustainable growth, provided that it continues to deliver on its promises and expands its user base.

Volume Change Analysis

Trading Volume Trends

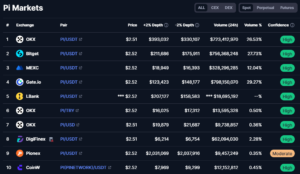

Trading volume is a critical indicator of market interest and liquidity. Recent data from CoinMarketCap shows a noticeable spike in trading volumes during the recent upside move. Key observations include:

- Volume Spike: During the rally, trading volume increased significantly, indicating that a wide range of market participants were active. This surge in volume supports the notion that the price move was driven by genuine buying interest rather than a thinly traded anomaly.

- Sustained Activity: The elevated volume has persisted even after the initial surge, suggesting that investors remain engaged and are possibly positioning themselves for further gains.

Liquidity Impact

Enhanced liquidity is a double-edged sword—it can lead to more stable prices but also enable rapid price changes. For PI Coin:

- Price Stability: Higher liquidity generally leads to less volatile price movements. However, the current environment of high volume and market speculation means that even liquid markets can experience sharp price swings.

- Investor Confidence: The robust trading activity observed during the rally is a positive signal for investors, as it indicates a healthy level of market participation and confidence in the coin’s prospects.

Comparative Volume Analysis

When comparing the current volume trends with historical data:

- Historical Baselines: PI Coin has experienced similar volume spikes in the past, often preceding significant price movements. Comparing the current surge with historical patterns can help identify whether this move is part of a larger cyclical trend or an isolated event.

- Peer Comparison: By analyzing volume trends of similar projects, investors can gain insights into whether PI Coin’s performance is unique or reflective of broader market dynamics in the altcoin space.

These volume trends are crucial in assessing the sustainability of the recent upside move and in forecasting future price behavior.

Technical Chart Analysis

Price Action and Chart Patterns

A detailed examination of PI Coin’s technical charts reveals important insights into its current market behavior:

Key Support and Resistance Levels

- Support Levels: Technical analysis shows that PI Coin has established several key support levels. These price floors have historically acted as a buffer during downturns and could provide a safety net if market sentiment turns negative.

- Resistance Zones: On the upside, certain resistance zones have been identified. These are price points where selling pressure tends to increase, potentially stalling further gains. Breaking through these resistance levels will be critical for sustained upward momentum.

Bullish and Bearish Patterns

- Bullish Patterns: Recent chart patterns indicate a short-term bullish sentiment. For example, the formation of ascending triangles or cup-and-handle patterns can be seen as early signals of continued strength.

- Bearish Signals: Conversely, certain technical indicators suggest caution. In some instances, the charts show bearish divergence, where momentum indicators fail to confirm the rising price—indicating that the rally may be losing steam.

Technical Indicators

Several key technical indicators further clarify the current trend:

Moving Averages

- Short-Term vs. Long-Term: The 50-day moving average is currently trending above the 200-day moving average—a bullish sign in many markets. However, the proximity of these averages suggests that the momentum may not be strong enough to sustain the rally without further catalyst.

- Crossover Analysis: A bullish crossover in moving averages can signal a reversal in sentiment. Investors should monitor these indicators closely for any signs of divergence.

Relative Strength Index (RSI)

- Current RSI Levels: The RSI for PI Coin is currently in a neutral to slightly bullish zone, indicating that while the coin is not overbought, there is still room for upward movement.

- Divergence Patterns: RSI divergence, where the price moves differently than the RSI, is an important signal. In this case, if the RSI begins to show overbought conditions without a corresponding price increase, it may indicate an impending correction.

MACD (Moving Average Convergence Divergence)

- Momentum Analysis: The MACD is an essential tool for assessing momentum. A bullish MACD signal, characterized by the MACD line crossing above the signal line, supports the current upward trend. However, any signs of a bearish crossover should be noted as a warning.

Trend Analysis

Combining the above technical indicators and chart patterns, the following insights emerge:

- Short-Term Trends: The recent price action suggests that, in the short term, PI Coin is experiencing bullish momentum. However, technical indicators signal that this move may be overextended if key resistance levels are not broken.

- Long-Term Outlook: Long-term trends remain less clear. The coin’s historical performance shows periods of rapid gains followed by corrections. The current rally needs to be viewed within the context of these cyclical patterns.

Technical analysis, while invaluable, should be integrated with fundamental and market data to provide a holistic view of PI Coin’s future prospects.

Holder Dynamics and Whale Activities

Change in Number of Holders

The number of unique holders of PI Coin is a critical metric for assessing its long-term viability:

Recent Holder Trends

- Increase in Holders: Data from blockchain explorers and platforms like CoinMarketCap indicate an increase in the number of holders following the recent rally. This growth is a positive signal, suggesting that more investors are confident enough in the project to add it to their portfolios.

- Distribution of Holdings: A diversified holder base is a strong indicator of organic growth. A scenario where only a few large holders control the majority of coins is less favorable compared to one with a wide, distributed base of small to medium-sized holders.

Whale Activities

Large-volume trades by “whales” (big holders) can have a significant impact on price stability and future moves:

Overview of Whale Movements

- Recent Whale Activity: Analysis of on-chain data reveals that several large addresses have increased their holdings during the recent price surge. This activity can be interpreted in two ways—either as a sign of confidence from institutional-level investors or as a potential risk if these holders decide to offload significant amounts of the coin.

- Impact on Price Stability: When whales accumulate PI Coin, it can act as a stabilizing force, as they are less likely to engage in panic selling. However, if a large whale were to sell off their holdings abruptly, it could trigger a sharp decline in price.

Strategic Implications

Monitoring whale activities provides insight into market sentiment at the highest levels. Consistent accumulation by whales generally indicates long-term confidence, whereas sudden sell-offs could signal that major investors are repositioning in anticipation of market changes.

Adoption and Community Sentiment

Adoption is the lifeblood of any cryptocurrency. For PI Coin, increased user adoption signals that the project is meeting its goal of mass inclusivity:

Recent Adoption Milestones

- New Partnerships and Integrations: Over the last week, there have been several announcements regarding new partnerships that integrate PI Coin into various decentralized applications (dApps) and platforms. These partnerships can drive real-world usage and further enhance the coin’s utility.

- Ecosystem Expansion: The ongoing expansion of the PI Coin ecosystem, including integrations with payment solutions and social platforms, suggests that the coin is not just a speculative asset but a functional part of a broader digital economy.

Community Engagement

The strength of a cryptocurrency’s community is a key determinant of its success:

Social Media Sentiment Analysis

- Insights from X.com: Analysis of community sentiment on X.com (formerly Twitter) shows robust engagement, with users discussing the recent upside move, sharing technical analysis, and speculating on future developments. Hashtags related to PI Coin have seen increased usage, and influencers in the crypto space are actively commenting on its potential.

- Forum and Chat Activity: Beyond social media, crypto forums and chat groups have recorded a surge in discussions centered on PI Coin. The overall sentiment appears to be optimistic, with many community members expressing confidence in the project’s long-term vision.

Sentiment Metrics

- Engagement Rates: High levels of likes, retweets, and comments on posts related to PI Coin are indicative of strong community support.

- Sentiment Scores: Tools that analyze sentiment across social media platforms show a predominantly positive outlook, with a growing number of bullish posts and articles.

Implications for Future Adoption

A vibrant and engaged community is essential for sustained adoption. The increased number of holders, combined with positive sentiment across various platforms, bodes well for the long-term viability of PI Coin. However, this positive momentum must be maintained through continuous project development and clear communication from the team.

Impact of New Exchange Listings

New exchange listings are pivotal moments for any cryptocurrency, as they significantly enhance accessibility:

Recent Listings for PI Coin

- Overview of New Listings: In the past week, PI Coin has been added to several reputable exchanges. These new listings are attracting additional liquidity and increasing the coin’s visibility to a broader investor base.

- Timing and Context: The timing of these listings appears to coincide with the recent upside move, suggesting a potential catalyst effect. Exchange listings often lead to increased trading volumes and can serve as validation for the project.

Market Accessibility

The availability of PI Coin on major exchanges directly impacts its market performance:

Enhanced Liquidity and Exposure

- Increased Liquidity: New exchange listings improve liquidity by making it easier for investors to buy and sell the coin. This, in turn, can lead to more stable price movements and reduced slippage during trades.

- Broader Market Exposure: With PI Coin now accessible on more platforms, it can attract investors from different regions and segments of the market, potentially driving further adoption.

Listing Impact on Price

Historical data suggests that new exchange listings often trigger positive price movements:

- Price Reaction Patterns: Past listings for other cryptocurrencies have frequently led to immediate price upticks, followed by increased trading activity.

- Future Effects: For PI Coin, the current listings could serve as a springboard for sustained upward momentum if the increased liquidity and market exposure translate into broader investor adoption.

Future Outlook and Scenarios

Under favorable conditions, PI Coin could continue its upward trajectory:

Conditions for Continued Growth

- Sustained Adoption: If the recent surge in community interest translates into increased real-world usage and ecosystem expansion, the coin could see further appreciation.

- Positive Market Sentiment: Continued bullish sentiment on social media and among key influencers can help maintain investor confidence.

- Technological and Partnership Catalysts: Ongoing technological improvements, along with new strategic partnerships, could act as catalysts for further price increases.

- Exchange Listings: As more reputable exchanges list PI Coin, the resulting increase in liquidity and exposure could sustain the bullish trend.

Potential Impact

In this optimistic scenario, PI Coin could not only maintain its current momentum but potentially reach new all-time highs. Investors would likely see a gradual yet steady upward trend, underpinned by strong fundamentals and widespread community support.

Pessimistic Scenario

Conversely, several risks could trigger a price correction or prolonged stagnation:

Risks and Challenges

- Market Correction: A broader market downturn or a shift in investor sentiment could lead to a rapid sell-off.

- Regulatory Uncertainty: New regulatory challenges or uncertainties could disrupt trading volumes and dampen market enthusiasm.

- Technological Setbacks: Any delays or issues with planned technological upgrades could undermine confidence in the project.

- Whale Sell-Offs: Large holders, or whales, might decide to offload significant portions of their holdings, triggering a sharp decline in price.

Potential Impact

Should these risks materialize, PI Coin could face a correction that erases much of the recent gains. In a worst-case scenario, the coin’s price might stagnate or even decline over the medium term, despite the strong community sentiment observed in the short term.

Key Catalysts to Watch

Several upcoming events and market trends could influence the future trajectory of PI Coin:

Upcoming Announcements

- Technological Upgrades: Any scheduled updates or new features could serve as a catalyst for renewed investor interest.

- New Partnerships: Announcements of partnerships with prominent platforms or institutions would likely boost confidence.

- Regulatory Developments: Clarity from regulators regarding digital assets can either support or hinder further growth, depending on the nature of the rulings.

- Market Trends: Broader trends in the crypto market, such as shifts in investor sentiment or changes in liquidity levels, will also play a crucial role.

Strategic Considerations for Investors

Given the current environment, investors should adopt a balanced approach:

Risk Management

- Diversification: Spread investments across various assets to mitigate risk.

- Stop-Loss Orders: Consider using stop-loss orders to protect against sudden market downturns.

- Regular Monitoring: Stay informed about both market data and news updates that could affect PI Coin’s price.

Long-Term Positioning

- Fundamental Focus: While short-term volatility is expected, maintaining a focus on PI Coin’s long-term fundamentals is essential.

- Engagement with Community: Investors should remain active within the PI Coin community to stay abreast of the latest developments and sentiment shifts.

- Strategic Patience: Given the volatile nature of crypto markets, a long-term perspective can help weather short-term corrections.

Final Thoughts

The journey of PI Coin is a microcosm of the broader challenges and opportunities in the cryptocurrency market. Its recent strong upside move demonstrates the potential for significant gains when fundamental developments align with market enthusiasm. However, as with all digital assets, the path forward is laden with uncertainties—from regulatory shifts and macroeconomic pressures to technical hurdles and the unpredictable behavior of large holders.

For investors and community members, the key lies in balancing optimism with caution. By understanding the intricate interplay between fundamentals, technical indicators, and market sentiment, stakeholders can better navigate the volatility that defines the crypto space. The future of PI Coin will be shaped by a combination of continued innovation, strategic partnerships, and effective risk management.

As we move forward, it is crucial to remain vigilant and adaptable. Whether you are a long-term investor or a trader looking to capitalize on market swings, staying informed and engaged is paramount. The evolution of PI Coin—and indeed, the broader crypto ecosystem—will depend on the ability of projects to deliver on their promises while weathering the inevitable storms of market volatility.

We invite you to share your thoughts and join the discussion on platforms like X.com, where community sentiment plays a vital role in shaping the narrative around PI Coin. Together, we can monitor these developments and adapt our strategies to harness the full potential of this exciting digital asset.

This article is for informational purposes only and does not constitute financial advice. Investors are encouraged to conduct their own research and consult with professional advisors before making any investment decisions.