The cryptocurrency landscape continues to be a breeding ground for innovation, controversy, and rapid evolution. Among the most intriguing assets in this space is PEPE—a meme coin that has captured the collective imagination of investors, traders, and meme enthusiasts alike.

In this comprehensive analysis, we explore PEPE’s origins, historical performance, market dynamics, competitive landscape, future predictions, and the risks and considerations that come with investing in such an asset. By the end of this report, you will have a balanced perspective on what the future might hold for PEPE amid evolving market conditions and broader trends in digital assets.

As a meme coin, PEPE draws its identity from internet culture, specifically the iconic “Pepe the Frog” meme. Despite its origins as a joke, PEPE has managed to generate a significant market capitalization and an extremely passionate community.

In an industry characterized by rapid fluctuations and high volatility, understanding the trajectory of a token like PEPE is crucial for both seasoned investors and newcomers. This article aims to dissect PEPE’s journey—from its early days to its current market standing—and to forecast potential future scenarios using historical data, technical analysis, and market sentiment studies.

Overview of PEPE

PEPE is a meme coin that leverages one of the internet’s most recognizable characters—Pepe the Frog. Initially popularized as a simple, humorous meme, Pepe the Frog has evolved into a cultural icon, used both humorously and, at times, controversially. PEPE capitalizes on this deep-rooted meme culture and uses it as its primary branding element.

Unlike many projects that promise groundbreaking technology or complex decentralized solutions, PEPE’s appeal lies in its simplicity, community engagement, and the viral nature of its origin. Despite being categorized as a meme coin—a class often dismissed for lacking inherent utility—PEPE has proven that the power of community sentiment can drive market value to unexpected heights.

The rapid rise of meme coins in recent years, exemplified by Dogecoin and Shiba Inu, has forced even the most traditional investors to pay attention. In an era where social media trends, online communities, and viral content can directly influence market behavior, understanding the future of a token like PEPE is more relevant than ever.

Amid evolving macroeconomic conditions and shifting regulatory landscapes, investors are not just interested in PEPE for its entertainment value but also for its potential as a high-risk, high-reward investment.

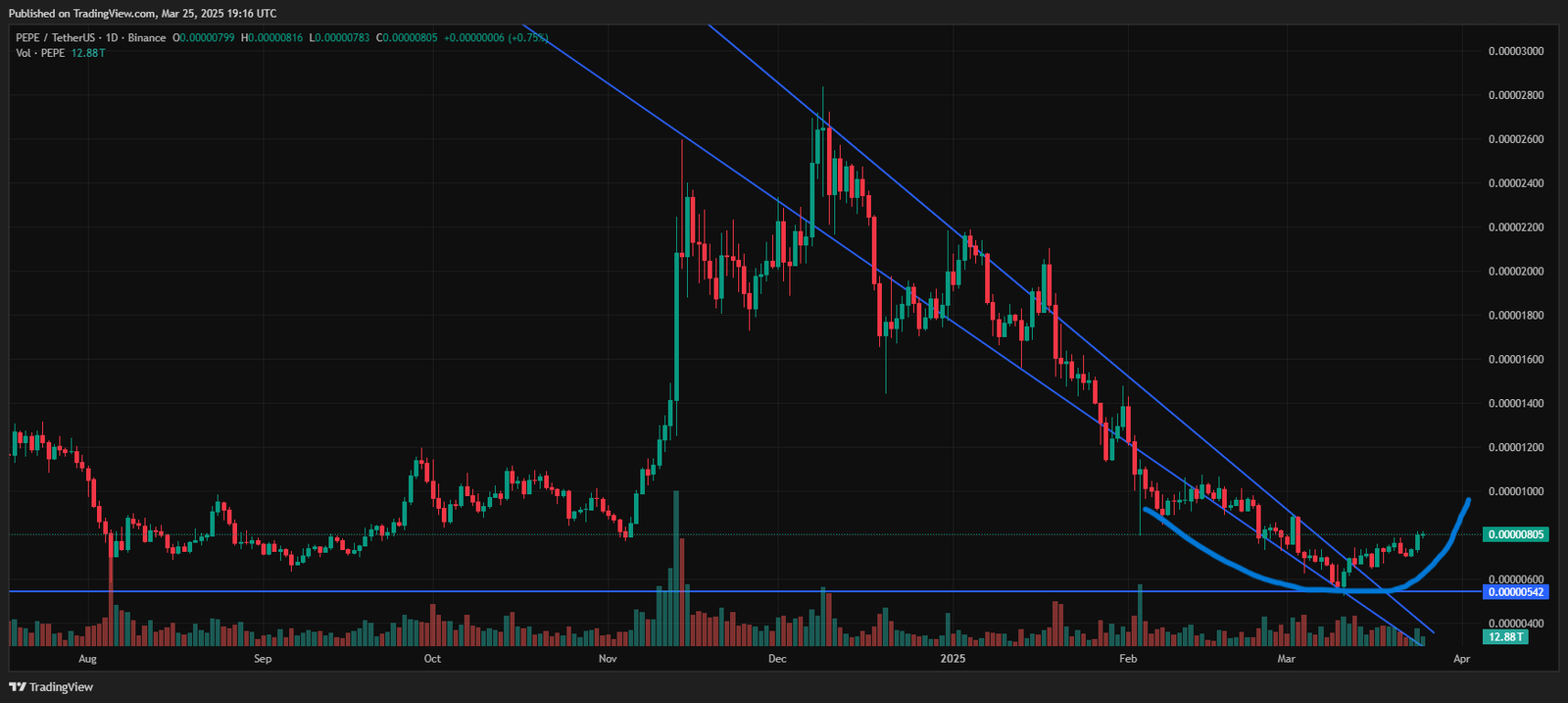

Technical Analysis Of PEPE Daily Chart

PEPE has broken out of a narrowing descending channel, signaling a potential shift from bearish to bullish momentum. A narrowing channel occurs when the price forms lower highs and lower lows within converging trendlines, often hinting at reduced volatility before a breakout. PEPE’s decisive move above the channel’s upper boundary around 0.00000060 indicates buyers are regaining control.

Simultaneously, the price action shows a U-shaped bottom, reflecting a gradual reversal from selling pressure to steady accumulation. This pattern often precedes bullish rallies, as it demonstrates a rounded shift in market sentiment.

Currently, 0.00000060 serves as the nearest support, where the breakout occurred. A retest of this level could confirm its strength if buyers step in aggressively. On the upside, 0.00000080 stands as the next significant resistance, aligning with previous pivot points. If PEPE breaks and holds above 0.00000080, it may target 0.00000090 or even 0.00000100, where psychological barriers could come into play. Monitoring volume spikes and momentum indicators will help confirm the sustainability of this upward move.

Relevance in Today’s Crypto Landscape

The crypto market has witnessed exponential growth and increased maturity over the last decade, yet meme coins continue to occupy a paradoxical niche. On one hand, they are often seen as frivolous and lacking substance; on the other, they have demonstrated the ability to generate massive returns in a short period, driven largely by viral marketing and community sentiment.

PEPE sits squarely at this intersection, where cultural impact meets market dynamics. In today’s digital environment, where social media influencers and online communities wield enormous power, meme coins like PEPE have proven that value can be created even without conventional utility.

Moreover, as regulatory bodies begin to scrutinize the crypto space more rigorously and macroeconomic conditions shift, the interplay between speculation and market fundamentals becomes increasingly complex. For investors, understanding these nuances is essential. This article will delve into the specific challenges and opportunities that PEPE faces in this volatile landscape, providing you with a roadmap to navigate the uncertainties ahead.

Background and Historical Performance

Origin and Evolution

PEPE was conceived as a meme coin in the wake of a surge in internet meme culture and the explosive popularity of similar projects such as Dogecoin and Shiba Inu. Its origins are rooted in the early 2020s when the internet was awash with memes that transcended their original humorous intent and became symbols of broader cultural movements.

The character Pepe the Frog, originally created by artist Matt Furie for his comic series, became a viral phenomenon. PEPE harnesses this cultural cachet to establish its brand identity, transforming a simple meme into a digital asset that resonates with a global community.

From its inception, PEPE was designed to be a community-driven project. Early adopters were drawn not just by the novelty of the meme but also by the promise of deflationary tokenomics—where a small percentage of tokens are burned with every transaction, thereby creating scarcity and potentially driving up the token’s value over time. Key milestones in PEPE’s evolution include its early listing on decentralized exchanges, rapid adoption by meme enthusiasts, and the significant social media buzz it generated.

The community’s active participation has been a cornerstone of PEPE’s evolution, with online forums, social media groups, and dedicated websites emerging to discuss strategies, share memes, and build hype around the token.

The evolution of PEPE is also marked by its ability to adapt to changing market conditions. In a short span of time, the token has moved from being a niche project to one that commands a multi-billion-dollar market cap, driven by speculative trading and the collective power of its online community.

This adaptability and the dynamic nature of its tokenomics continue to be vital in shaping PEPE’s trajectory, providing a blueprint for how meme coins can evolve beyond mere jokes into significant players in the crypto market.

Past Performance Analysis

Analyzing PEPE’s past performance provides essential insights into its potential future. Historically, PEPE has experienced extreme volatility—a hallmark of meme coins. Early trading data shows that shortly after its launch, PEPE’s price experienced meteoric rises punctuated by dramatic corrections.

For instance, following its initial surge, the token’s price skyrocketed due to a combination of viral social media posts and speculative trading, only to experience significant sell-offs as early investors took profits. Such extreme price movements are not uncommon in the meme coin sector and underscore the speculative nature of these assets.

Over the last several months, PEPE has shown periods of both exponential growth and sharp declines. Key performance metrics—such as trading volume, market capitalization, and daily price fluctuations—reflect the high-risk, high-reward dynamics that characterize meme coins.

For example, during peak hype moments, trading volumes have surged as large numbers of retail investors and speculators enter the market, often leading to temporary price spikes that can later be corrected by profit-taking and market consolidation.

Furthermore, historical data indicates that PEPE’s performance is heavily influenced by social media trends and viral marketing campaigns. Notable surges in price have often coincided with trending topics on platforms like Twitter, Reddit, and TikTok.

Visual aids such as price charts and volume graphs (commonly available on crypto data websites) illustrate these trends clearly, showing the correlation between online buzz and price movements. By reviewing these historical performance patterns, investors can gain a deeper understanding of the cyclical nature of meme coin valuations and the factors that have historically driven PEPE’s volatility.

Key Metrics and Data Points

To fully grasp PEPE’s past and potential future performance, it is crucial to analyze key metrics such as price, trading volume, market capitalization, and volatility indices. At its all-time high, PEPE reached a price of approximately $0.00002825, a figure that was driven largely by speculative trading and a surge in social media interest.

Trading volumes have varied widely over time, often spiking during periods of intense hype and receding during consolidation phases. The market capitalization of PEPE, which has soared into the billions, reflects not only the speculative interest but also the sheer scale of investor participation in meme coins.

These metrics provide a quantitative foundation for understanding PEPE’s market dynamics. For instance, the price-to-volume ratio can indicate periods of over-exuberance or panic selling, while the market cap offers a broader view of how the token is positioned relative to other digital assets.

Furthermore, technical indicators such as the Relative Strength Index (RSI), moving averages (50-day and 200-day), and Fibonacci retracement levels have been used by analysts to gauge momentum and potential reversal points in PEPE’s price trend. Together, these data points offer a comprehensive picture of PEPE’s performance history, which is essential for making informed forecasts about its future.

Market Dynamics Impacting PEPE

Investor Sentiment and Community Influence

Investor sentiment plays a pivotal role in the performance of meme coins like PEPE. In the case of PEPE, the strength of its online community and the viral nature of its meme cannot be overstated. Social media platforms—Twitter, Reddit, TikTok—act as amplifiers, where a single tweet or meme can trigger a massive influx of buyers or sellers. This phenomenon is largely driven by what can be described as a “bandwagon effect,” where investors, both retail and institutional, jump on the trend, often without delving deeply into fundamental analysis.

The community behind PEPE is exceptionally active, with members constantly discussing market movements, sharing memes, and posting technical analyses on various forums. This collective action not only fuels speculative trading but also creates an environment where sentiment can shift rapidly.

For instance, bullish signals often emerge when influential figures or groups within the community endorse the token, leading to rapid price increases. Conversely, negative sentiment—often spurred by profit-taking or external market news—can lead to swift declines.

Moreover, the speculative nature of meme coins means that investor sentiment is frequently more important than underlying fundamentals. Technical indicators such as trading volume spikes, short interest ratios, and social media mentions are used as proxies for gauging market mood.

In the case of PEPE, analysts have noted that its price surges are closely tied to viral marketing events, celebrity endorsements, and the overall excitement within the meme coin space. This dynamic creates a self-reinforcing cycle where positive sentiment leads to increased buying, which in turn drives the price up further—at least temporarily.

Given this environment, understanding the pulse of the community is essential for predicting short-term movements in PEPE’s price. Sentiment analysis tools and social media monitoring have become indispensable in this regard, as they help track the volume and tone of discussions around the token.

By keeping an eye on these indicators, investors can anticipate potential reversals or accelerations in the trend. However, this reliance on sentiment also means that PEPE is particularly vulnerable to sudden swings in investor mood, making it a highly volatile asset.

The interplay between sentiment and market behavior makes PEPE a fascinating study in behavioral finance. While traditional assets rely on fundamental performance indicators, meme coins like PEPE are largely driven by the collective psychology of their investors—a factor that can be both a boon and a bane.

Macroeconomic and Regulatory Factors

Beyond investor sentiment, broader macroeconomic and regulatory factors have a significant impact on the crypto market and, by extension, on meme coins like PEPE. Global economic conditions—such as inflation rates, interest rate decisions by central banks, and geopolitical events—can influence investor risk appetite.

For example, periods of economic uncertainty or tightening monetary policies often lead to a flight to safety, with investors moving away from volatile assets like meme coins in favor of more stable investments. Conversely, in a low-interest-rate environment, there is often an increased appetite for risk, which can result in a surge of speculative investments in cryptocurrencies, including PEPE.

Regulatory news is another critical driver. As governments around the world grapple with how to manage the rapid growth of digital assets, regulatory announcements can have an outsized impact on market sentiment.

For meme coins that are already seen as speculative and lacking intrinsic value, the potential for future regulation adds an extra layer of uncertainty. News of regulatory crackdowns, tax increases, or restrictions on trading can lead to sharp sell-offs. On the other hand, regulatory clarity—such as favorable rulings or the introduction of crypto-friendly policies—can bolster investor confidence and lead to market rallies.

PEPE, like other meme coins, exists in a particularly precarious regulatory environment. Given that its value is driven largely by community sentiment rather than technological innovation or real-world utility, regulators may view it as a high-risk asset. This could result in heightened scrutiny and possibly even bans or restrictions in certain jurisdictions.

Additionally, the influence of macroeconomic factors such as currency devaluation or economic stimulus measures can also indirectly impact PEPE. For example, if fiat currencies lose value due to inflation, investors might turn to cryptocurrencies as a hedge, potentially boosting demand for meme coins.

These external factors underscore the importance of staying informed about global economic trends and regulatory developments. For investors in PEPE, understanding these macro-level influences is crucial for timing entry and exit points and for managing overall portfolio risk. As governments and financial institutions continue to evolve their approaches to digital assets, the regulatory landscape will remain one of the most significant uncertainties affecting the future of PEPE.

Liquidity and Trading Volume Trends

Liquidity is a key factor in determining the price stability and overall health of any cryptocurrency market. For PEPE, liquidity has been highly variable, largely reflecting the token’s speculative nature. Trading volume trends offer a window into the market’s appetite for PEPE, and they have historically shown dramatic fluctuations corresponding to bursts of online hype and periods of market consolidation.

High liquidity, indicated by robust trading volumes, generally implies that a cryptocurrency can absorb large orders without significant price impact. For meme coins like PEPE, sudden surges in volume can trigger rapid price movements, both upward and downward.

For instance, when viral posts or influential endorsements occur, a spike in trading volume is typically observed as many investors rush to buy the token. However, the same liquidity that facilitates these rapid surges can also exacerbate declines when market sentiment turns sour. In low-liquidity conditions, even modest selling pressure can result in large price drops, highlighting the inherent risk associated with trading meme coins.

Technical analysts often use liquidity metrics in conjunction with other indicators, such as order book depth and bid/ask spreads, to assess market sentiment and potential price movements. With PEPE, a sudden increase in volume may signal the start of a bullish rally, but it can also indicate that a profit-taking phase is underway.

Moreover, liquidity trends are closely tied to the behavior of “whales” or large holders of the token. When a significant portion of PEPE tokens is moved off exchanges into private wallets, it reduces available liquidity and can lead to increased price stability—or, conversely, can trigger panic selling if those tokens are suddenly released back into the market.

Understanding these trends is particularly important for investors, as it provides clues about market cycles and potential reversal points. For example, a prolonged period of low trading volume combined with an accumulation phase among long-term holders might suggest that the token is building a foundation for future gains. Conversely, sudden spikes in volume accompanied by dramatic price swings often indicate high volatility and the potential for rapid corrections.

Competitive Landscape

Overview of Leading Meme Coins

PEPE is not alone in the meme coin space. Other well-known names such as Dogecoin (DOGE) and Shiba Inu (SHIB) have established themselves as significant players, often commanding large market capitalizations and strong community support.

Dogecoin, originally created as a joke, has transformed into a major cryptocurrency largely due to endorsements by high-profile figures like Elon Musk and its active community. Shiba Inu, similarly, has built a robust ecosystem that includes its own decentralized exchange (Shibarium) and various utility projects, further cementing its position as a leading meme coin.

When compared to its peers, PEPE’s performance is unique in that it draws on the cultural resonance of Pepe the Frog—a meme that has had a long and controversial history on the internet. This distinct identity gives PEPE a branding edge, as it taps into both nostalgia and current meme trends.

However, while Dogecoin and Shiba Inu have made strides in developing utility (e.g., through partnerships, integration into payment systems, and community-driven projects), PEPE’s utility remains minimal. Its value is driven primarily by speculative interest and community hype rather than by concrete technological innovations or real-world applications.

Despite this, PEPE has managed to carve out a niche by appealing to a subset of investors who are drawn to its irreverent, fun image and the possibility of rapid, speculative gains. The competitive landscape for meme coins is crowded, with new projects emerging frequently.

In this dynamic environment, the ability of PEPE to maintain its relevance depends on its capacity to continuously engage its community and differentiate itself from competitors that might offer additional features or more robust ecosystems.

The evolution of the meme coin space is a testament to the power of internet culture and the influence of viral marketing. Even though utility remains a common criticism, the market has repeatedly demonstrated that community sentiment and cultural impact can drive significant valuation increases. As such, PEPE’s future will be influenced not only by its own performance but also by the broader trends and innovations occurring among its peers in the meme coin sector.

Unique Selling Points of PEPE

One of the primary factors that set PEPE apart from other meme coins is its strong and dedicated community. Unlike many tokens that fade into obscurity after the initial hype, PEPE’s community is highly active, continuously creating and sharing content, technical analyses, and trading strategies. This robust engagement helps sustain investor interest even during periods of market downturn and provides a social safety net that can help stabilize price fluctuations.

Another unique selling point is PEPE’s deflationary mechanism. With a built-in feature that burns a small percentage of tokens with every transaction, the circulating supply is gradually reduced over time. In theory, this scarcity can drive up the token’s value if demand remains high.

While such mechanisms are common in the meme coin space, PEPE’s execution of this feature has resonated well with investors, many of whom see it as a way to hedge against inflationary pressures common in cryptocurrencies.

Additionally, the cultural significance of Pepe the Frog cannot be overlooked. Despite its controversial connotations in some circles, the meme has become deeply ingrained in internet culture and has a dedicated following.

This cultural capital provides PEPE with a form of brand recognition that is difficult for newer meme coins to replicate. It also means that PEPE can capitalize on any resurgence in interest in the meme itself, creating potential catalysts for future price rallies.

Furthermore, the simplicity of PEPE’s model—without the complexities of layered protocols or additional utility functions—can be seen as a strength in a market where many investors appreciate straightforward, speculation-friendly assets. The token’s ease of understanding and the light-hearted nature of its branding appeal to a wide audience, from serious traders to casual investors looking for a fun entry point into the crypto market.

Challenges and Threats from Competitors

Despite its strengths, PEPE faces significant challenges in a competitive landscape that is both crowded and rapidly evolving. The primary threat comes from other meme coins that are not only competing for the same investor base but are also increasingly incorporating additional utility and technological enhancements.

Tokens like Dogecoin and Shiba Inu have managed to evolve beyond their original humorous roots, developing ecosystems that offer staking, decentralized applications, and payment integrations. These added layers of functionality can attract investors looking for more than just speculative gains.

Moreover, the volatile nature of meme coins means that market sentiment can shift quickly, and any negative publicity or regulatory scrutiny can have an outsized impact on price. PEPE’s lack of tangible utility makes it particularly vulnerable to such shifts.

As regulators around the world begin to focus more intently on cryptocurrencies, assets that are perceived as high-risk or lacking in substantive value may face additional hurdles. This could limit the token’s growth potential or even lead to significant sell-offs if investor confidence wanes.

Another challenge is the potential dilution of market interest due to the constant emergence of new meme coins. With numerous projects vying for attention, PEPE must continuously innovate its branding and maintain community engagement to stay relevant. The risk is that over time, the novelty of the meme may wear off, leading investors to shift their focus to newer, flashier projects that promise similar gains but with additional features or stronger narratives.

Competitive pressures are further intensified by market saturation and the tendency for speculative bubbles to form and burst within the meme coin segment. While PEPE’s strong community has helped it weather previous storms, future price movements will be heavily influenced by how effectively it can differentiate itself and sustain long-term interest. Without significant changes or enhancements to its underlying model, PEPE might find it increasingly difficult to command the same level of enthusiasm as its early days.

Future Predictions and Forecasting

Short-Term Outlook

In the short term, the future of PEPE is likely to be characterized by extreme volatility and rapid price movements driven largely by market sentiment and speculative trading. Technical indicators suggest that in the coming weeks, PEPE could experience short bursts of upward momentum, particularly if there is renewed viral activity on social media platforms.

Indicators such as the Relative Strength Index (RSI) and moving averages have provided mixed signals; while some trends are showing signs of recovery from oversold conditions, others indicate that caution is warranted.

The immediate outlook is further complicated by external factors such as sudden changes in regulatory news, macroeconomic shifts, and influential endorsements or criticisms on social media. For instance, if a well-known crypto influencer or celebrity were to publicly endorse PEPE, it could trigger a short-term rally.

Conversely, negative sentiment arising from regulatory announcements or market-wide downturns could cause a rapid decline in price. Historical data suggests that meme coins often experience sharp spikes in price followed by equally sharp corrections. This cyclical pattern is expected to continue in the near future.

Trading volume is another critical aspect of the short-term outlook. Periods of high volume often coincide with rapid price movements and can serve as early indicators of market sentiment shifts. For PEPE, any sudden surge in volume may signal that investors are repositioning themselves in anticipation of a breakout. On the other hand, if volume dries up, it could indicate a pause in investor interest, setting the stage for further downward pressure.

Long-Term Potential and Growth Drivers

Looking beyond the immediate horizon, the long-term future of PEPE presents a more complex picture. Despite its origins as a meme coin with little intrinsic utility, PEPE has managed to carve out a niche due to its strong community and the deflationary nature of its tokenomics. Over the next five to ten years, several key factors could drive its growth and adoption.

One of the primary long-term growth drivers is the sustained engagement of its community. A loyal and active community can create lasting value for a meme coin, even in the absence of conventional utility.

As PEPE continues to build its brand through viral marketing, community events, and online engagement, it may attract a new wave of investors looking for high-risk, high-reward opportunities. Additionally, should the token begin to integrate with broader crypto ecosystems—perhaps through partnerships with decentralized finance (DeFi) platforms or inclusion in payment systems—it could gain more practical utility, thus bolstering its long-term prospects.

Another factor that could drive long-term growth is the evolution of market sentiment towards meme coins in general. As the broader cryptocurrency market matures, there is potential for meme coins to transition from speculative assets to more established components of diversified portfolios.

This shift could be catalyzed by improved regulatory frameworks that provide greater clarity and protection for investors. If regulatory bodies eventually recognize meme coins as legitimate investment vehicles, this could lead to increased institutional participation, further driving demand and price appreciation for PEPE.

Technological advancements could also play a role. While PEPE currently lacks significant utility beyond its meme value, future upgrades or ecosystem developments could enhance its functionality.

Innovations such as interoperability with other blockchains, integration into NFT platforms, or even gamification elements could transform PEPE into a more versatile asset. Such developments would not only broaden its use cases but also attract a wider range of investors, from speculators to long-term holders.

Finally, macroeconomic trends such as low-interest-rate environments and global economic uncertainty can push investors towards alternative assets like cryptocurrencies. In periods where traditional financial markets underperform, assets like PEPE—despite their volatility—may see increased inflows as investors diversify their portfolios in search of higher returns. This influx of capital, combined with the aforementioned factors, could set the stage for sustained long-term growth.

Scenario Analysis

When forecasting the future of PEPE, it is essential to consider a range of potential scenarios, each with its own set of assumptions and outcomes. The best-case scenario for PEPE envisions continued community growth, successful integration into broader crypto ecosystems, and favorable regulatory developments.

In this scenario, renewed viral interest and increased institutional participation drive the token’s value to new heights. Advanced technical integrations and strategic partnerships could also unlock additional utility, making PEPE a more integral part of decentralized finance and online payment systems.

Conversely, the worst-case scenario would see PEPE succumbing to market saturation, regulatory crackdowns, or a significant loss of community interest. Given its reliance on sentiment and speculative trading, any sustained negative news or a broader market downturn could lead to prolonged price declines.

The lack of inherent utility could exacerbate this decline, as investors may gradually lose faith in its ability to generate long-term value. Additionally, if competitors in the meme coin space manage to innovate more effectively or secure critical partnerships, PEPE’s market share could be eroded.

A moderate scenario falls somewhere between these extremes. In this case, PEPE continues to experience periods of volatility, with short-term price spikes interspersed with corrections. The token may not reach the lofty heights envisioned in the best-case scenario, but it would still maintain a respectable position within the meme coin market.

Over time, moderate technological improvements and a stable community base could allow PEPE to appreciate steadily, albeit with significant fluctuations along the way. This scenario would likely involve a balanced mix of speculative trading and genuine adoption, with the token serving as both a high-risk asset and a cultural icon.

Scenario analysis underscores the inherent uncertainty of investing in meme coins like PEPE. Given the wide range of potential outcomes, investors should be prepared for multiple eventualities and consider strategies that allow for flexibility and risk management. Diversification, continuous monitoring of market trends, and adherence to a disciplined trading approach are essential tools for navigating this unpredictable environment.

Risks and Considerations

Market Volatility and Speculative Risks

One of the most significant risks associated with investing in PEPE is its extreme volatility. As a meme coin, PEPE’s price movements are largely driven by speculative trading and social media sentiment rather than fundamental value.

This means that prices can swing wildly in a short period, often without any clear external catalyst. For instance, viral trends or the sudden withdrawal of large holders—commonly known as “whales”—can trigger rapid price fluctuations, both upward and downward. While such volatility can present opportunities for traders to make quick profits, it also poses a serious risk for those who hold the asset for the long term.

The speculative nature of PEPE means that its value is largely contingent on investor perception and market hype. In a market characterized by rapid sentiment changes, even a minor shift in public opinion or a piece of negative news can lead to drastic price drops.

This level of unpredictability is a double-edged sword: while it may enable large gains during bullish phases, it also increases the potential for significant losses during bearish spells. Historical trends in the meme coin space have shown that tokens like PEPE can experience dramatic rallies followed by equally steep corrections, leaving inexperienced investors exposed to high levels of risk.

Moreover, the high volatility in the PEPE market is often compounded by the relatively low liquidity compared to more established cryptocurrencies. In situations where trading volumes are low, even moderate sell orders can cause disproportionately large price drops. This further increases the risk for investors, as the market may not be able to absorb large transactions without significant impact on the price.

Traders and investors need to adopt a robust risk management strategy when dealing with highly volatile assets like PEPE. This may include setting stop-loss orders, diversifying their portfolio to spread risk, and only investing amounts they are willing to lose. Given that meme coins are among the riskiest assets in the crypto market, a clear understanding of one’s risk tolerance and investment goals is essential before committing capital.

The speculative environment of PEPE also means that traditional valuation metrics may not apply. Instead, investors often rely on technical analysis, social media trends, and market sentiment indicators to make their decisions. While these tools can offer some guidance, they are far from foolproof in a market where emotion and hype drive behavior. Ultimately, the inherent volatility and speculative risk of PEPE make it a high-risk asset that may yield high returns, but only for those who are prepared to weather the inevitable ups and downs.

Regulatory and Economic Uncertainties

The future of PEPE is not determined solely by market sentiment and community dynamics; it is also heavily influenced by regulatory and macroeconomic factors. As governments and regulatory bodies around the world increasingly scrutinize the cryptocurrency space, meme coins like PEPE could face significant challenges.

Regulatory actions, such as bans on certain types of crypto trading or increased compliance requirements, can have an immediate and profound impact on the token’s price. Given that meme coins are often seen as speculative and lacking in intrinsic value, they may become early targets for stricter regulation, potentially leading to reduced investor confidence and liquidity.

In addition to regulatory risks, broader economic conditions play a crucial role. Global macroeconomic trends such as inflation, interest rate changes, and geopolitical events can all affect investor behavior. In times of economic uncertainty or market downturns, investors might flee from high-risk assets like PEPE in favor of safer investments. Conversely, in a low-interest-rate environment with abundant liquidity, speculative assets might see increased inflows as investors seek higher returns. However, such conditions are often short-lived and can reverse rapidly, adding another layer of uncertainty to PEPE’s future performance.

Economic uncertainties also affect the broader cryptocurrency market, which in turn impacts meme coins. For example, if major cryptocurrencies like Bitcoin or Ethereum experience significant corrections due to economic headwinds, the entire market sentiment could sour, dragging down even the most popular meme coins.

Moreover, if regulatory bodies implement new rules that affect crypto exchanges or trading platforms, access to assets like PEPE might become restricted, further limiting market participation and liquidity.

Investors must remain vigilant and stay informed about regulatory developments and economic trends that could affect their investments. Keeping abreast of policy changes, central bank announcements, and global economic indicators is essential for anticipating market shifts and managing risk in a rapidly changing environment. Understanding these external factors is particularly important for meme coins, which often have little intrinsic utility to fall back on during adverse conditions.

Risk Mitigation Strategies

Given the high risks associated with investing in PEPE, adopting a comprehensive risk mitigation strategy is essential. First and foremost, diversification remains one of the most effective ways to manage risk in any portfolio. Rather than concentrating investments solely in PEPE or other meme coins, investors should consider spreading their capital across a range of asset classes—including more established cryptocurrencies, stocks, and bonds—to buffer against sudden market downturns.

Additionally, setting strict stop-loss orders and using position sizing techniques can help limit losses in the event of a rapid price drop. These strategies are particularly important in a market known for its volatility, as they can prevent emotional decision-making and help maintain a disciplined approach to trading.

Another critical strategy is continuous monitoring of market sentiment and technical indicators. Given that meme coins like PEPE are highly sensitive to social media trends and speculative buzz, real-time analysis tools and sentiment tracking can provide early warning signals of potential reversals. Investors should leverage tools such as RSI, moving averages, and volume analysis to gauge market momentum and adjust their strategies accordingly.

Finally, staying informed about regulatory developments and macroeconomic trends is paramount. By understanding the broader context in which PEPE operates, investors can anticipate potential risks before they materialize and make more informed decisions about when to enter or exit positions.

It may also be prudent to consult with financial advisors who specialize in cryptocurrency investments, ensuring that one’s risk management strategy is both robust and adaptive to the rapidly changing market environment.

Implementing these risk mitigation strategies can help investors navigate the turbulent waters of meme coin trading, offering a measure of protection against the inherent volatility of assets like PEPE.

Conclusion

PEPE stands as a fascinating case study in the cryptocurrency market—an asset born out of internet meme culture that has evolved into a multi-billion-dollar token. Its journey, characterized by rapid surges and steep corrections, is a testament to the power of community sentiment and viral marketing.

Historically, PEPE’s price performance has been driven by speculative trading, with social media buzz playing a critical role in shaping its value. Key metrics such as trading volume, market capitalization, and technical indicators like RSI and moving averages provide a quantitative backbone to its volatile behavior.

In addition, the market dynamics influencing PEPE are multifaceted. Investor sentiment, amplified by online communities, remains one of the most significant drivers of its price. Macroeconomic conditions and regulatory developments also cast long shadows over its future, making the token highly sensitive to external factors. Liquidity trends further compound these dynamics, with periods of high trading activity often leading to rapid price movements.

The competitive landscape is equally challenging. While PEPE benefits from a unique cultural identity and a dedicated community, it faces stiff competition from other meme coins such as Dogecoin and Shiba Inu. These competitors have begun to integrate more utility and innovative features into their ecosystems, potentially threatening PEPE’s market share if it fails to evolve.

Looking forward, the short-term outlook for PEPE is likely to be volatile, driven by speculative trading and rapid sentiment shifts. In the long term, however, the token’s future will depend on its ability to maintain community engagement, adapt to regulatory changes, and possibly integrate new utility features.

Scenario analysis reveals that while the best-case scenario envisions significant growth driven by renewed hype and institutional participation, the worst-case scenario could see a prolonged decline if market sentiment turns negative or regulatory pressures mount. A moderate scenario, characterized by cyclical price movements and gradual appreciation, appears most likely given the current market environment.

Final Thoughts on PEPE’s Future

The future of PEPE is a microcosm of the broader challenges and opportunities in the cryptocurrency market. It embodies the unpredictable nature of meme coins—where cultural impact and community sentiment can drive exponential gains, but where volatility and speculative risks are ever-present.

For investors, PEPE represents a high-risk, high-reward proposition. Its potential to generate significant returns is counterbalanced by the inherent uncertainties associated with meme-based assets, including regulatory scrutiny, market saturation, and rapidly shifting investor sentiment.

In this context, PEPE’s long-term success will likely depend on its ability to innovate and evolve beyond its initial novelty. While its current model, driven primarily by speculation and cultural resonance, has delivered impressive results, sustaining long-term growth may require the integration of additional utility or strategic partnerships. Nonetheless, for those willing to navigate its volatile landscape with caution and disciplined risk management, PEPE remains a compelling asset that could continue to surprise the market.

Key Take-Away

Investing in meme coins like PEPE is not for the faint-hearted. If you are considering adding PEPE to your portfolio, it is imperative to conduct thorough research and remain vigilant about market trends. Stay informed about regulatory changes, macroeconomic shifts, and social media trends that could impact the token’s performance.

Engage with reputable analysis sources and consider consulting with financial advisors who specialize in cryptocurrencies. Ultimately, the future of PEPE is in the hands of its community and the broader market dynamics—so be prepared to act swiftly and strategically in this fast-paced environment.

As you contemplate the future of PEPE, remember that in the world of crypto, even a meme can become a market force. Whether you view PEPE as a fleeting trend or as a long-term speculative opportunity, understanding its dynamics is essential to making informed investment decisions. Happy investing!

This analysis is provided for informational purposes only and should not be construed as investment advice. Always perform your own due diligence and consult a financial professional before making any investment decisions.