In a surprising twist amid the volatile crypto market, a well-known analyst has forecasted that Bitcoin could soon experience a downturn, potentially settling near the $60,000 mark. As cryptocurrency enthusiasts and investors digest this prediction, the news has sparked lively debates across social media and industry forums.

The analyst’s views reflect broader market dynamics, regulatory pressures, and a shifting global economic landscape, all of which contribute to uncertainty in the crypto sphere.

The analyst, recognized for providing insightful market forecasts, cited several factors driving the bearish outlook. Chief among these is the increasing regulatory scrutiny facing cryptocurrencies worldwide.

Governments and financial authorities are ramping up efforts to enforce stricter oversight on digital assets, which could dampen investor enthusiasm and add a layer of caution among market participants. This evolving regulatory environment has prompted many to speculate that Bitcoin’s bullish run may be approaching its peak, urging investors to brace themselves for a period of correction.

Another key element behind the prediction is the heightened market volatility observed over recent months. Bitcoin has enjoyed an explosive rally in previous years, but that very history of rapid price surges now serves as a double-edged sword.

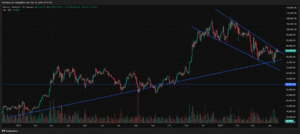

While previous upswings have attracted new investments and boosted confidence in digital currencies, the rapid corrections that sometimes follow have also led to significant sell-offs. The current prediction of a potential drop to $60,000 is partly attributed to technical resistance levels that, if breached, could trigger a cascade of automated sell orders and force a market realignment.

Experts have pointed out that the cryptocurrency market tends to mirror sentiment trends seen across traditional financial markets. Any signs of economic slowdown or geopolitical tensions can have an outsized impact on Bitcoin, which many investors now regard as a risk asset.

The analysis suggests that increased instability in traditional markets—ranging from fluctuating interest rates to international trade disputes—may spill over into the crypto world. This interdependence could be a critical factor in driving Bitcoin’s price downward, offering one explanation for why some investors are preparing for a possible correction.

Amid this backdrop, some financial commentators argue that while a drop to $60,000 might create short-term pain, it could also present a strategic entry point for long-term investors. Historically, Bitcoin has demonstrated strong recoveries after periods of consolidation and adjustment.

Investors who view the cryptocurrency as a revolutionary financial asset might see this predicted dip as an opportunity to increase their exposure at a lower cost basis. The balance between caution and opportunism defines much of the current market sentiment, with both skeptics and supporters keeping a close eye on emerging trends.

The entertainment industry has also embraced the news, highlighting the inherent drama of the crypto market. In many ways, Bitcoin has become a symbol of the modern financial revolution—stepping outside the confines of traditional banking while delivering stories as captivating as any blockbuster plot twist.

As industry influencers comment on the forecast, they weave narratives that blend both financial expertise and high-stakes entertainment. This dual focus ensures that even those with a casual interest in technology are drawn into the unfolding story.

With headlines predicting substantial price corrections and expert panels dissecting every market movement, Bitcoin’s story is evolving in real time. The conversation surrounding Bitcoin is not confined merely to investor circles; it has permeated popular culture, social media, and even mainstream news channels.

This broad exposure underscores the dual nature of cryptocurrencies as both high-risk investments and a cultural phenomenon that captures the public’s imagination.

Looking ahead, market watchers remain divided. Some analysts stress that technological advancements and wider adoption of blockchain technology could help stabilize prices in the long run. They emphasize that Bitcoin’s fundamental value lies in its ability to serve as a hedge against inflation and a decentralized alternative to traditional finance. Others, however, warn that any premature euphoria about Bitcoin’s recovery could lead to complacency, potentially setting the stage for further volatility.

The tension between these divergent viewpoints reflects an industry in flux. As the predictive models and technical analyses evolve, Bitcoin may well be on the cusp of one of its many dramatic turns. Industry veterans urge investors to remain vigilant, diversify their portfolios, and stay informed about both market fundamentals and regulatory developments.

While no prediction can guarantee a specific outcome in the highly unpredictable cryptocurrency market, the notion of Bitcoin sliding to $60,000 has certainly reinvigorated discussions among those who invest, analyze, and entertain the possibilities of the digital asset revolution.

As the narrative unfolds, all eyes are on Bitcoin. With influential voices on both sides of the debate and a global audience watching, the coming months promise to be a defining period for cryptocurrency. Investors are advised to weigh the long-term promise of the technology against the immediate market pressures. In doing so, they continue to navigate one of the most dynamic and enthralling financial landscapes of our time.