Shiba Inu (SHIB) remains one of the most talked-about meme coins in the crypto market. After enjoying a spectacular run-up to around $0.000035, Shiba has since experienced a prolonged decline, with its price hovering near $0.000012 at the time of writing. This marks a drop of about 66% from its seasonal high, leaving many traders and investors wondering if a major turnaround is on the horizon—or if the coin’s best days are behind it.

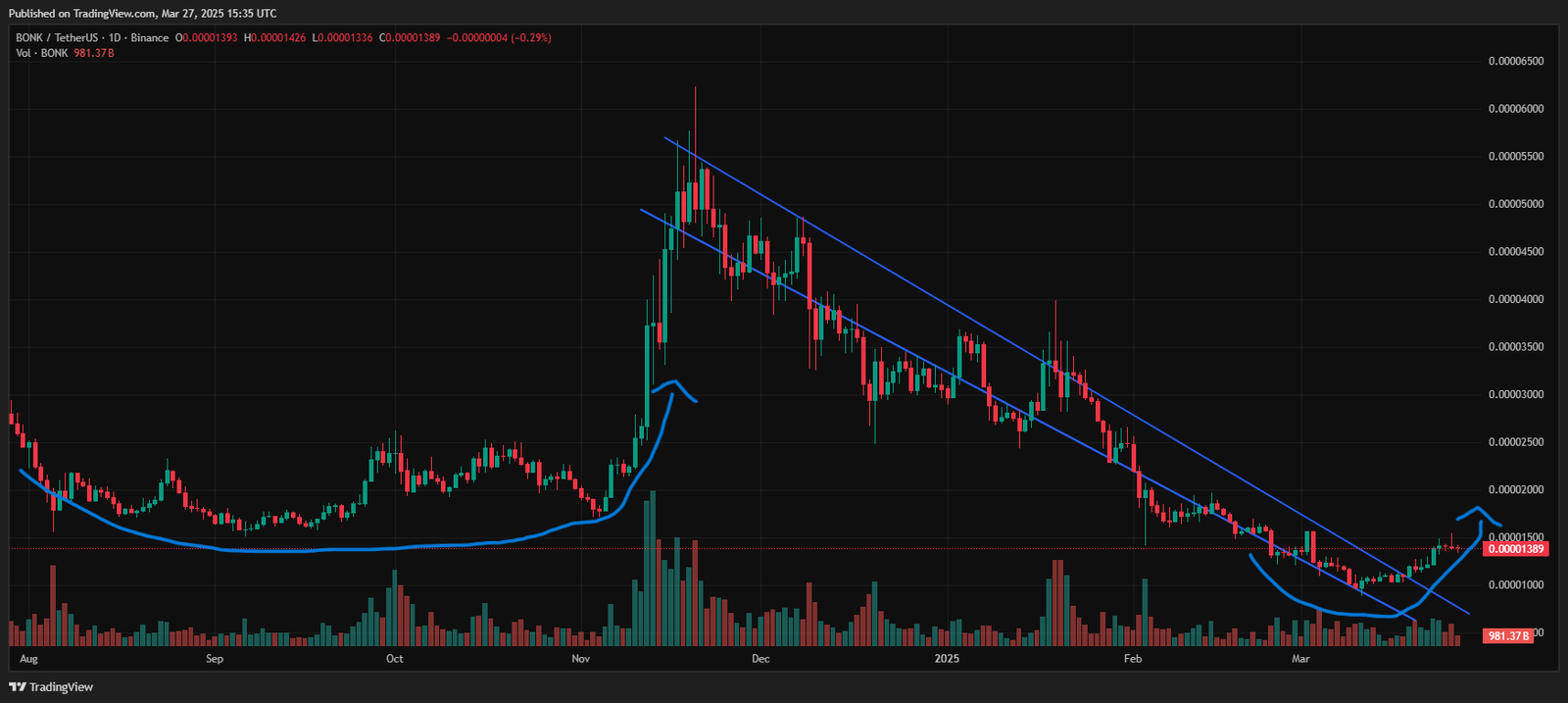

On the daily chart, Shiba has formed a narrowing descending channel, which indicates that volatility is compressing. Typically, when price action narrows in such a pattern, it can be a precursor to a sizable breakout in either direction. In this blog post, we will delve into the technical analysis behind Shiba’s chart patterns, discuss key support and resistance levels, and examine on-chain data such as whale holdings and addresses by time held. By the end, you will have a clearer understanding of where Shiba Inu stands and what might spark the next big move.

Shiba’s Price Action: From $0.000035 to $0.000012

Shiba Inu’s climb to $0.000035 was fueled by a surge of investor enthusiasm, social media hype, and broader meme-coin mania. However, the subsequent cooldown has been significant. From $0.000035 down to its current price near $0.000012, SHIB has lost approximately 66% of its value. This retracement underscores how swiftly sentiment can shift in the crypto market—particularly for meme coins that rely on community excitement.

Despite this substantial drop, SHIB’s market cap remains robust, hovering around $7.43 billion, placing it firmly within the top 20 cryptocurrencies by market capitalization. This demonstrates that while the hype may have subsided, there is still a dedicated base of holders and traders supporting Shiba Inu’s ecosystem.

Shiba Daily Chart at a Glance

On the daily chart, Shiba is tracing out a narrowing descending channel. Visually, this appears as two converging trendlines sloping downward, with price action trapped between them. Each time SHIB attempts to push higher, it encounters resistance at the upper trendline; each time it slides lower, buyers step in near the lower boundary. Over time, these swings have become tighter, creating a “wedge-like” formation.

Such patterns often precede strong breakouts or breakdowns, as the market reaches a point of indecision. Eventually, supply or demand wins out, causing a rapid move in one direction. The big question for Shiba investors is whether that decisive move will be a breakout toward the upside or a break below key support levels.

Understanding the Narrowing Descending Channel

A descending channel is a bearish chart pattern by default, reflecting a series of lower highs and lower lows. However, when the channel starts to narrow, it can signal waning bearish momentum. This occurs because each new low is not as severe as the previous one, suggesting that sellers may be losing steam. Alternatively, the pattern could represent buyers gradually running out of enthusiasm, leading to a slow bleed in price.

Potential Outcomes of the Channel

- Upside Breakout: If buyers become more aggressive—perhaps spurred by positive news, increased volume, or an overall bullish shift in the crypto market—Shiba could break above the channel’s upper trendline. Such a move would often be confirmed by a spike in trading volume. In this scenario, SHIB could rally toward its next resistance level, potentially targeting $0.000014 or $0.000016 in the near term.

- Downside Breakdown: If the support fails to hold, Shiba might drop below the lower trendline, signaling a continuation of the downtrend. Given the strong support zone near $0.000012, a break below this area might drive the price toward $0.000010, which many analysts consider the next significant support. A deeper sell-off could occur if overall crypto sentiment turns negative, pushing Shiba into uncharted territory below $0.000010.

Key Support and Resistance Levels

Shiba is currently hovering around $0.000012, which has served as a major support level in recent weeks. This zone aligns with the lower boundary of the descending channel, making it a critical line of defense. If buyers can consistently defend $0.000012, the coin may have a chance to build momentum for a breakout. Conversely, losing this level would likely trigger a wave of stop-loss orders and panic selling, sending SHIB lower.

Next Support: $0.000010

Should Shiba break below $0.000012, the next logical support could be $0.000010. This level is psychologically significant—partly because it represents a round number, and partly because it served as an accumulation zone in previous consolidation phases. A failure to hold $0.000010 would raise serious concerns among traders, as it might signal that the meme coin’s price structure is deteriorating further.

Overhead Resistance: $0.000014 to $0.000016

On the upside, the first major resistance lies in the $0.000014–$0.000016 range, roughly corresponding to the descending channel’s upper boundary and previous swing highs. A decisive close above $0.000016—especially on higher-than-average volume—could indicate that SHIB is ready to exit the downtrend. Beyond this zone, further resistance might appear near $0.000018 or $0.000020, levels that served as pivot points during the coin’s earlier declines.

On-Chain Analytics: Whales and Addresses

Whale Holdings at 58.37%

Shiba Inu’s on-chain data shows that 58.37% of the circulating supply is held by whales. These large holders can significantly influence price action, as their buying or selling decisions often create substantial shifts in market sentiment. If whales decide to accumulate more SHIB at these levels, it could spark a bullish reversal. Conversely, if they begin offloading their holdings, retail investors might panic, accelerating a downtrend.

Addresses by Holdings

- $0 – $1k: 93.42%

- $1k – $100k: 6.42%

- $100k+: 0.16%

This distribution reveals that most Shiba Inu addresses hold relatively small amounts (under $1,000). While this broad base can indicate a strong community, it also means that the coin is largely driven by retail sentiment. When market conditions turn unfavorable, retail investors might be more prone to panic selling. Conversely, if the coin gains traction on social media or receives positive coverage, these small holders can collectively fuel rapid price spikes.

Addresses by Time Held

- Holders (75.50%): Addresses holding SHIB for a long time, indicating faith in the project’s future.

- Cruisers (22.05%): Addresses holding for a moderate timeframe, often waiting for better market conditions before selling.

- Traders (2.45%): Addresses that move in and out quickly, contributing to short-term price volatility.

A high percentage of long-term holders (75.50%) suggests a core community that believes in Shiba’s potential. This can help stabilize the price during downturns, as these holders are less likely to sell at the first sign of trouble. However, if overall sentiment worsens and even a fraction of these long-term holders decide to exit, it could apply immense downward pressure due to the sheer number of tokens they possess.

What Happens If Shiba Holds the Support?

Potential for a Strong Bounce

If Shiba successfully defends the $0.000012 support and breaks out of the narrowing descending channel, traders may interpret this as a strong bullish signal. Typically, the first upside target would be the $0.000014–$0.000016 resistance zone, but a surge in buying volume could push the price higher. Given Shiba’s history of sudden, meme-driven rallies, a swift move toward $0.000018 or $0.000020 is not out of the question, especially if the broader crypto market also turns bullish.

Catalysts for a Pump

- Market-Wide Rally: If Bitcoin and other major altcoins experience a resurgence, Shiba could benefit from the inflow of capital into riskier assets.

- Social Media Buzz: Shiba’s community is known for its strong online presence. A wave of positive tweets, memes, or celebrity endorsements can rapidly attract new buyers.

- Whale Accumulation: An uptick in whale addresses or a known whale purchasing more SHIB can spark renewed interest, as retail investors often follow whale movements.

- Project Developments: News of upcoming Shiba ecosystem upgrades, partnerships, or adoption in DeFi and NFT platforms can trigger a bullish breakout.

Risk Management

Even if Shiba bounces, caution is essential. Traders might consider setting stop-loss orders below the $0.000012 support or trailing stops that adjust as the price moves up. Meme coins can be highly volatile; a pump can quickly turn into a dump if the hype fades or if whales decide to take profits.

What Happens If Shiba Breaks the Support?

If Shiba closes decisively below $0.000012, the next major support lies around $0.000010. Losing that level could be a red flag for many investors, potentially causing a cascade of sell orders. As the coin drifts further away from its seasonal high, sentiment could deteriorate, and the downward trend may intensify.

Impact on Holders

Long-term holders might still hold onto their positions, hoping for a future recovery. However, cruisers and traders could capitulate, leading to further downside pressure. Whales might also see an opportunity to accumulate at cheaper prices—if they believe in the project’s long-term viability—or they might cut their losses if they sense diminishing returns.

Possible Recovery Points

Even if Shiba breaks below $0.000012, it is not necessarily the end of the project. Meme coins have a knack for reviving from seemingly hopeless conditions. A new marketing push, fresh exchange listings, or an unexpected surge in community engagement could spark a rebound. However, the deeper the price falls, the more effort it takes to climb back, as early buyers may become discouraged or shift focus to other assets.

Final Words

Shiba Inu’s narrowing descending channel reflects a market in limbo—neither buyers nor sellers have been able to establish a definitive trend. With the coin hovering around a $0.000012 support zone, the stage is set for a pivotal move. A successful defense of this level could ignite a run toward $0.000014–$0.000016, or possibly higher, if volume surges and whale accumulation picks up. On the other hand, a break below $0.000012 might send SHIB spiraling toward $0.000010, intensifying bearish sentiment.

On-chain data offers additional context. Whale holdings of 58.37% mean a few large wallets have the potential to sway the market dramatically. Meanwhile, the majority of addresses hold less than $1,000 worth of SHIB, suggesting that retail sentiment can shift the price rapidly if fear or hype dominates. The fact that over 75% of addresses are long-term holders indicates a base of believers who could help stabilize the coin, yet even a small fraction of these holders deciding to sell could exert significant downward pressure.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Always conduct thorough research and consult with financial professionals before making investment decisions.