In its early days, dogwifhat rode the wave of social media hype. Investors, many of whom were new to the crypto market, found its playful design and the possibility of dramatic price swings enticing. The coin’s market performance was marked by spectacular rallies, followed by significant dips—typical of meme coins. This volatility has fueled debates about its long-term viability and raised the question: Is dogwifhat dead, or will it rebound to new all-time highs?

Dogwifhat (WIF) Price Analysis

Dogwifhat (WIF) is currently hovering around the $0.53062 support level, following a significant downtrend from its all-time high of approximately $5. The price has been trapped in a steep downward channel, as indicated by the trendline drawn from the peak.

Bearish Scenario – Next Support Level Below $0.53062

If WIF breaks below the $0.53062 support level, the next critical support is around $0.08643. This level represents a historically significant price zone where demand could step in to prevent further downside. Such a drop would indicate a continuation of the bearish trend, possibly leading to a period of price consolidation before any potential reversal.

- A breakdown below $0.53062 could trigger stop-loss liquidations, accelerating the decline.

- If $0.08643 fails to hold, the asset may enter a prolonged accumulation phase before recovery.

Bullish Scenario – Key Resistance Levels to Watch

If WIF holds above $0.53062 and bounces, the first major resistance level to watch is around $1.38709 – $1.50. This range previously acted as support during the decline, and now it may act as a strong resistance zone.

- A successful breakout above $1.50 could open the door for a move toward $4.77820, which marks a previous high and a major psychological resistance level.

- The 20-day SMA ($0.61051) is a short-term hurdle that must be reclaimed for bullish momentum to build.

Understanding the Current Situation

From a technical perspective, dogwifhat’s price movements provide a mixed picture. Recent trends indicate that the coin is trading in a range marked by well-established support and resistance levels. Key technical indicators include:

- Moving Averages: The coin’s short-term and long-term moving averages have crossed paths on several occasions. A crossover, particularly when the short-term moving average rises above the long-term average, is typically seen as a bullish signal. However, caution is advised since these patterns can sometimes produce false signals in highly volatile markets.

- Relative Strength Index (RSI): The RSI for dogwifhat has fluctuated between overbought and oversold conditions. An RSI that moves into the oversold region might signal a potential buying opportunity, while an overbought condition could indicate that the coin is due for a correction.

- MACD (Moving Average Convergence Divergence): The MACD line’s behavior relative to its signal line has provided insights into the momentum behind price movements. A bullish crossover in this indicator can be a positive sign, but given the coin’s past volatility, traders remain cautious.

Chart patterns also play a crucial role in the technical analysis of dogwifhat. Patterns such as double bottoms, head-and-shoulders formations, or even bullish reversal patterns can offer clues about potential future trends. However, the coin’s inherent volatility means that even promising patterns require confirmation from other indicators.

Market Sentiment and Community Engagement

Market sentiment is a critical factor for meme coins, and dogwifhat is no exception. The coin’s price and trading volume are strongly influenced by community engagement and social media trends. Currently, several factors shape the market sentiment:

- Social Media Buzz: Platforms like Twitter, Reddit, and specialized crypto forums continue to drive discussions about dogwifhat. Positive sentiment on these platforms can lead to increased buying pressure, while negative sentiment can trigger rapid sell-offs.

- Trading Volume: Analyzing trading volume provides insights into the level of interest and participation in the coin’s market. High trading volumes during price surges indicate strong market participation, but they can also signal the potential for increased volatility.

- Investor Sentiment: Surveys and online sentiment analysis tools often capture the mood of the investor community. While many investors remain optimistic about meme coin trends, skepticism persists regarding the long-term viability of tokens without clear utility.

External Influences

The broader regulatory and economic environment also exerts significant influence on dogwifhat’s performance:

- Regulatory Landscape: Governments and financial regulators worldwide are increasingly scrutinizing cryptocurrencies, particularly those that lack clear utility. Any adverse regulatory decisions can have a pronounced impact on meme coins.

- Economic Trends: Global economic factors, such as inflation, interest rates, and shifts in investor risk appetite, can indirectly affect meme coins. In times of economic uncertainty, speculative investments like dogwifhat may either see a surge due to risk-on sentiment or a drop as investors flock to safer assets.

- Crypto Market Trends: The overall health of the cryptocurrency market influences individual tokens. When major cryptocurrencies such as Bitcoin and Ethereum experience volatility, meme coins often follow suit due to correlated market dynamics.

Understanding these external factors is essential for evaluating whether dogwifhat is poised for a recovery or is destined for further decline. Investors must weigh technical signals against broader market trends to gauge the coin’s future trajectory.

Factors That Could Lead to a Rebound

Despite its turbulent history, there are signs that dogwifhat may be positioning itself for a rebound:

- Bullish Chart Patterns: Some technical analysts have identified emerging bullish patterns in the coin’s charts. Patterns like ascending triangles or double bottoms could signal that a rebound is underway.

- Support Level Bounces: Historical data shows that dogwifhat has often bounced back when it reached significant support levels. These levels, determined by previous trading ranges, provide a cushion against further declines.

- Momentum Shifts: Indicators such as the RSI and MACD have, at times, signaled a shift in momentum. When these indicators align, they may point to a potential turnaround, suggesting that buyers are beginning to re-enter the market.

It is important to note that while these indicators provide a framework for optimism, they are not guarantees. The volatile nature of meme coins means that even positive technical signals require confirmation from broader market trends and community sentiment.

Community and Developer Initiatives

Another critical factor in a potential rebound is the role of the dogwifhat community and its developers:

- Active Community Engagement: A strong, engaged community can drive positive sentiment and sustained interest. Initiatives such as community-led marketing campaigns, social media challenges, and regular updates can invigorate investor confidence.

- Developer Roadmaps: While many meme coins lack intrinsic utility, proactive developers can introduce updates or partnerships that enhance the token’s value proposition. New features, planned partnerships, or innovative use cases—even if initially modest—can provide the necessary spark for a recovery.

- Transparency and Communication: Regular, transparent communication from the development team can alleviate investor concerns. When investors are well-informed about future plans, it can create a foundation for renewed optimism and support.

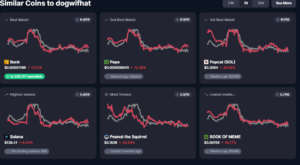

Comparisons to Other Meme Coins

History provides several examples of meme coins that have rebounded from severe downturns:

- Dogecoin: Once dismissed by many as a joke, Dogecoin has experienced multiple comebacks driven by social media support, celebrity endorsements, and community-driven initiatives. Dogecoin’s resurgence underscores the power of meme culture in the crypto world.

- Shiba Inu: Similarly, Shiba Inu saw dramatic swings in its price, with periods of intense hype leading to rapid gains, followed by corrections. However, strategic initiatives and a robust community have allowed Shiba Inu to maintain relevance in the market.

- Lessons for dogwifhat: The experiences of these coins illustrate that while meme coins can be extremely volatile, they are not immune to recovery. By learning from the successes (and failures) of their counterparts, dogwifhat could implement strategies that boost investor confidence and drive a turnaround.

Arguments Suggesting dogwifhat May Be Dead

One of the most critical arguments against dogwifhat’s long-term viability is its inherent lack of fundamental utility. Unlike cryptocurrencies that serve as platforms for decentralized finance (DeFi) or smart contract execution, dogwifhat is primarily a meme coin. Its value is driven by social media buzz and speculative trading rather than real-world applications. This reliance on hype makes it vulnerable:

- Hype-Driven Valuation: Without intrinsic utility, any rally in dogwifhat’s price is largely dependent on market sentiment and viral trends. When the hype subsides, the coin may struggle to retain its value.

- Sustainable Growth Concerns: Long-term success in the crypto market often depends on continuous innovation and practical use cases. Dogwifhat’s absence of a robust ecosystem or utility means that its future growth is inherently uncertain.

Persistent Bearish Trends

The technical analysis of dogwifhat has shown that bearish trends can persist for extended periods:

- Extended Downtrends: Historical data reveals instances where dogwifhat experienced prolonged periods of decline with few signs of recovery. Such trends, when combined with negative sentiment, can reinforce a bearish outlook.

- Unresolved Controversies: Ongoing debates about the coin’s value proposition, coupled with unresolved controversies or management issues, have further dampened investor enthusiasm.

- Market Skepticism: As the crypto market matures, investors are increasingly cautious about assets that lack solid fundamentals. Persistent bearish trends in technical indicators can lead to a self-reinforcing cycle of pessimism, where investors withdraw support, driving the price lower.

Oversaturation of the Meme Coin Market

The explosive growth in meme coin offerings has led to an oversaturated market:

- Increased Competition: With numerous meme coins vying for attention, dogwifhat faces stiff competition. This saturation diminishes its unique appeal and makes it harder to stand out.

- Dwindling Investor Attention: As investors diversify their portfolios among various meme coins, the concentrated support that once bolstered dogwifhat’s price may dissipate, leaving it vulnerable to declines.

- Risk of Fads: The meme coin market is notorious for its ephemeral trends. What was once a viral sensation can quickly become a forgotten fad, leading to a sharp drop in demand and value.

These factors present a sobering view of dogwifhat’s prospects. While there remains a possibility for recovery, the combination of a lack of fundamental utility, persistent bearish trends, and market oversaturation forms a compelling argument that the coin may be nearing its end rather than preparing for a comeback.

Expert Opinions and Analyst Predictions

Crypto analysts remain divided on the future of dogwifhat. Opinions vary widely, reflecting the inherent uncertainties in predicting the trajectory of meme coins:

- Bullish Analysts: Some experts argue that dogwifhat is merely experiencing a temporary setback. They point to emerging bullish technical patterns, active community engagement, and potential upcoming developer initiatives as indicators that a recovery is on the horizon.

- Bearish Analysts: In contrast, many analysts caution that without significant fundamental changes, dogwifhat’s decline could continue. These experts emphasize the coin’s lack of intrinsic value and compare it unfavorably to more utility-focused projects.

- Neutral Stance: A number of market watchers maintain a neutral stance, suggesting that while a rebound is possible, investors should remain vigilant. They stress the importance of risk management, diversification, and continuous monitoring of market indicators.

Quantitative Price Predictions

Price predictions for dogwifhat vary considerably:

- Optimistic Projections: Some forecasts suggest that if the coin manages to break through key resistance levels and capitalize on positive market sentiment, it could reach new all-time highs. These projections are based on technical models that factor in past recovery patterns observed in similar meme coins.

- Conservative Estimates: Other models take a more conservative approach, predicting modest recoveries that might stabilize the coin’s price rather than sending it soaring. These estimates are tempered by the recognition that meme coins are subject to unpredictable market forces.

- Assumptions Behind Predictions: It is crucial to understand that these predictions rest on assumptions regarding investor behavior, regulatory developments, and broader market trends. Any unexpected shifts in these factors could lead to significant deviations from forecasted outcomes.

Expert opinions, while diverse, underscore the importance of a nuanced approach when considering an investment in dogwifhat. The coin’s future may depend as much on external market conditions and community initiatives as it does on its inherent technical factors.

Investor Considerations and Risk Management

Investing in meme coins like dogwifhat comes with a unique set of risks:

- High Volatility: Meme coins are notorious for their wild price swings. Sudden rallies can be followed by precipitous drops, often without clear warning signs.

- Speculative Nature: With values driven largely by social media and hype, meme coins may not be anchored in strong fundamentals. This makes them particularly vulnerable to market sentiment shifts.

- Regulatory Risks: As regulators increase scrutiny of the crypto market, meme coins could face additional challenges. Unfavorable regulatory actions may exacerbate price declines and deter new investments.

- Market Manipulation: The relatively low liquidity and high speculative nature of meme coins can sometimes lead to market manipulation by large holders, further increasing the risk for retail investors.

Strategies for Cautious Investment

For those considering an investment in dogwifhat, risk management strategies are paramount:

- Diversification: Never invest solely in one asset. Spreading investments across a range of cryptocurrencies and traditional assets can reduce overall risk.

- Dollar-Cost Averaging: Rather than making a lump-sum investment, consider investing small amounts over time. This strategy can help mitigate the effects of short-term volatility.

- Stop-Loss Orders: Setting predetermined exit points can help protect investments from rapid declines.

- Continuous Monitoring: Given the fast-paced nature of meme coin markets, staying informed about market trends and technical indicators is essential.

When to Consider Exiting or Holding

Investors should look for clear signals that indicate whether to exit or hold their positions:

- Technical Reversals: A confirmed reversal in technical indicators (e.g., a strong bullish crossover or a bounce from established support levels) may suggest that holding the coin is worthwhile.

- Market Sentiment Shifts: Positive developments in community engagement and favorable shifts in market sentiment could be a green light for holding or even increasing exposure.

- Regulatory News: Keep a close eye on any regulatory announcements that might affect meme coins. Negative regulatory news is often a precursor to sharp declines.

- Personal Investment Goals: Ultimately, every investor’s risk tolerance and financial goals are different. Whether to exit or hold should be based on one’s personal investment strategy and the broader market environment.

A cautious and informed approach is crucial when navigating the turbulent waters of meme coin investments. By understanding and mitigating these risks, investors can make more confident decisions about their exposure to dogwifhat.

Final Thoughts

For investors, the story of dogwifhat is a compelling case study in the risks and rewards associated with meme coins. While the potential for dramatic gains is alluring, the inherent volatility and speculative nature of such tokens demand a cautious approach. Investors should always perform thorough due diligence, consider diversification, and be prepared for rapid market shifts.

In the final analysis, dogwifhat’s future remains a balancing act between hype and reality. Whether it rebounds to new all-time highs or fades into obscurity will likely depend on the interplay of community momentum, market forces, and timely innovations by its development team. As always, prospective investors are encouraged to do their own research, stay abreast of market developments, and manage risk carefully.

Disclaimer: This analysis is intended for informational purposes only and should not be construed as financial advice. Always perform your own research before making any investment decisions.