In recent years, geopolitical tensions and economic policies have increasingly influenced financial markets worldwide. Among these, tariffs imposed by political figures—most notably those under the Trump administration—have drawn considerable attention. While tariffs traditionally affect commodities, manufacturing, and international trade, their ripple effects extend even into the global crypto market. In this comprehensive analysis, we delve into how Trump tariffs might influence the crypto market.

We examine the fundamental economic impact, market sentiment, technical analysis, and various potential scenarios. This post will provide you with a full understanding of what to expect from the crypto market under different tariff-driven conditions.

Overview of Trump Tariffs

Tariffs are taxes imposed on imported goods and are typically used as a tool of economic policy to protect domestic industries, rebalance trade deficits, or exert political pressure. Under President Donald Trump, the U.S. government implemented tariffs on various products—most notably on Chinese steel, aluminum, and a broad array of manufactured goods. These tariffs were designed to reduce the trade deficit and protect American industries, but they also ignited trade tensions and spurred retaliatory measures from other nations.

Crypto Market Context

The cryptocurrency market is unique in that it operates on a global, decentralized network largely insulated from the direct influence of national policies. However, traditional economic policies such as tariffs can indirectly affect digital assets. Factors such as inflation, currency valuation, and global economic growth—all of which are influenced by tariff policies—can have significant spillover effects on cryptocurrencies. In a world where macroeconomic policies and global trade dynamics drive investor sentiment, even digital assets are not entirely immune.

Purpose of the Post

This post aims to analyze the potential effects of Trump tariffs on the crypto market by examining:

- Fundamental Economic Impact: How tariffs can alter macroeconomic indicators like inflation, currency strength, and overall economic growth, and what that means for cryptocurrencies.

- Market Sentiment: How political uncertainty and economic policy shifts influence investor risk appetite and sentiment in the crypto space.

- Technical Analysis: Examination of historical price patterns, support and resistance levels, and key technical indicators in response to economic shocks.

- Scenario Outcomes: A detailed look at optimistic, pessimistic, and mixed scenarios regarding the impact of tariffs on digital assets.

By exploring these areas, readers will gain a comprehensive understanding of how Trump tariffs might affect the crypto market and what potential future scenarios could look like.

What Are Tariffs?

Tariffs are taxes levied on imported goods, intended to raise the price of foreign products to give domestic products a competitive edge. They serve as a tool for governments to protect local industries, negotiate trade deals, and, at times, respond to unfair trade practices by other nations. In practice, tariffs can have far-reaching impacts, affecting everything from consumer prices to international supply chains.

Overview of Trump’s Tariff Policies

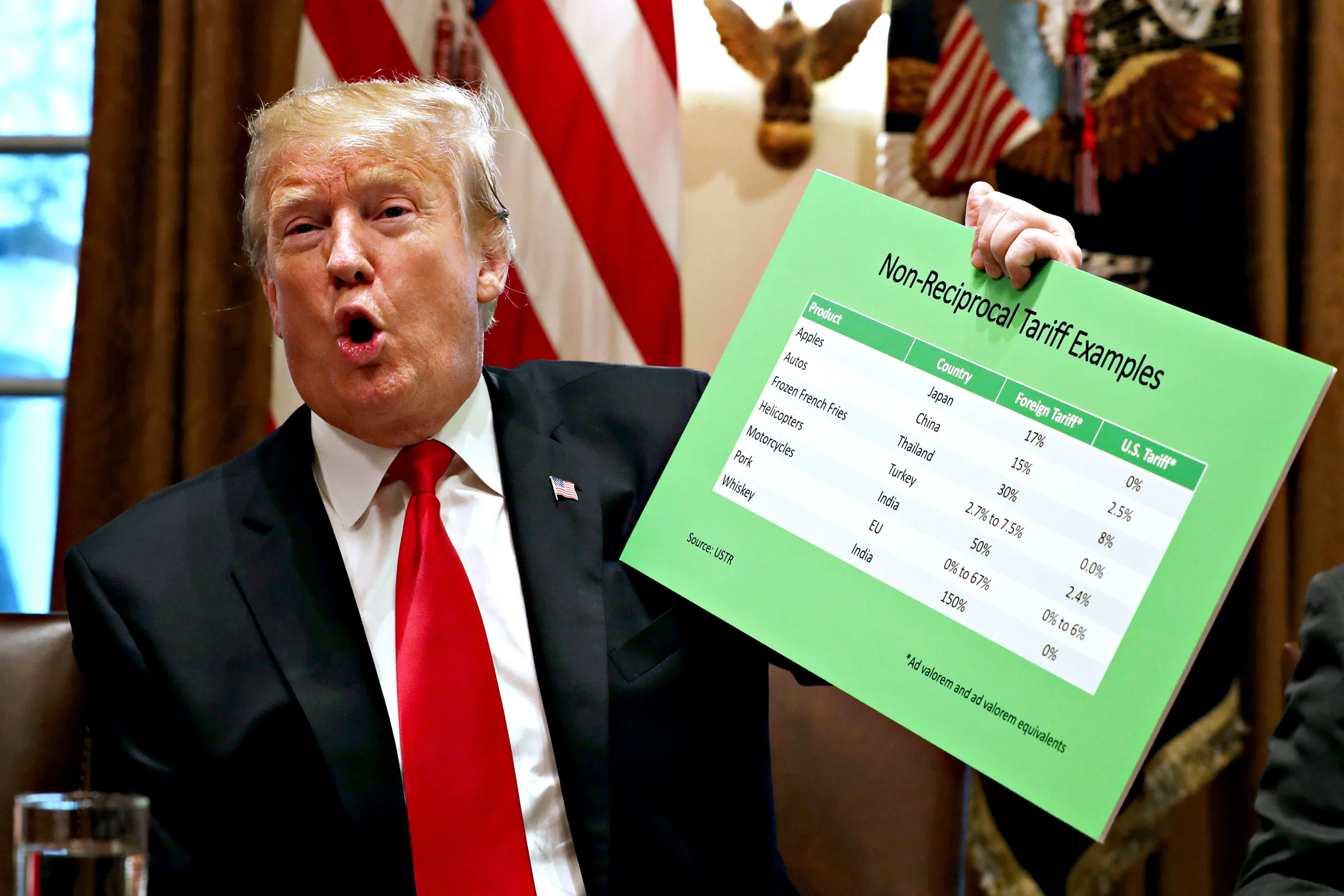

Under the Trump administration, the United States imposed tariffs on a wide array of products. Notable examples include:

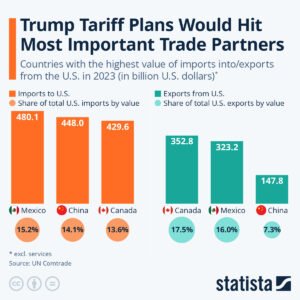

- US-China Trade Tensions: Tariffs were placed on billions of dollars’ worth of Chinese imports to counteract what the U.S. perceived as unfair trade practices.

- Steel and Aluminum Tariffs: Tariffs on these critical industrial inputs aimed to bolster American manufacturers by making imported goods more expensive.

- Broad-Based Tariffs: In addition to targeted sectors, tariffs were also imposed on various consumer goods and technology products, affecting global supply chains and international trade dynamics.

Why Were These Tariffs Implemented?

The primary rationale behind Trump tariffs was to address long standing issues in U.S. trade:

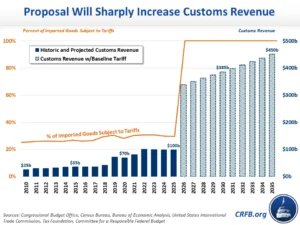

- Trade Deficit Reduction: The tariffs were meant to decrease the trade imbalance by discouraging imports.

- Domestic Industry Protection: By making imported goods more expensive, domestic industries would theoretically benefit from increased demand for locally produced products.

- Political Leverage: Tariffs were also used as a tool to negotiate more favorable trade deals and to pressure other countries into revising their trade policies.

Intended Effects on Domestic Industries and International Trade

While tariffs can protect domestic industries in the short term, they often lead to unintended consequences, such as:

- Increased Costs for Consumers: Higher prices for imported goods can lead to inflationary pressures.

- Retaliation from Trade Partners: Other countries may impose their own tariffs in response, which can disrupt global supply chains.

- Economic Uncertainty: The unpredictability of tariff policies can increase uncertainty in global markets, affecting investment decisions across asset classes—including cryptocurrencies.

Crypto Market Fundamentals in a Global Economy

Cryptocurrencies have emerged as an alternative asset class, offering diversification benefits in a portfolio traditionally dominated by fiat currencies, stocks, and bonds. They are increasingly seen as:

- A Hedge Against Inflation: With a finite supply (as in the case of Bitcoin) or utility-driven value (as seen with various altcoins), crypto assets are considered by some investors as a hedge against inflation.

- A Speculative Investment: The high volatility of cryptocurrencies makes them attractive for traders seeking significant short-term gains.

- A Tool for Financial Inclusion: Decentralized finance (DeFi) and other blockchain applications have democratized access to financial services, providing opportunities in markets that are underserved by traditional banking systems.

Relationship with Traditional Fiat Currencies and Global Trade

Even though the crypto market operates independently of traditional financial systems, its value is not entirely detached:

- Fiat Currency Influence: Fluctuations in fiat currency values, driven by macroeconomic policies like tariffs, can affect the relative attractiveness of cryptocurrencies.

- Global Trade Impact: Changes in global trade dynamics—resulting from tariff policies—can influence investor sentiment. For instance, a devaluation in a major currency due to economic strain may drive investors toward alternative assets, including cryptocurrencies.

Interdependence of Markets

Economic policies and global market dynamics are interconnected:

- Historical Impact on Asset Classes: Traditional asset classes have shown that trade policies and tariffs can lead to significant market adjustments. For example, tariffs have historically impacted commodity prices, stock markets, and even real estate.

- Spillover Effects to Crypto: Although cryptocurrencies are decentralized, they are influenced by the same global economic forces. For example, increased inflation or currency devaluation can lead to higher demand for crypto assets as a store of value.

This interdependence means that while cryptocurrencies operate on their own technological frameworks, their valuation is still tied to broader economic policies and global market trends.

Direct Impacts of Trump Tariffs on the Crypto Market

The imposition of tariffs creates uncertainty in traditional markets, which can influence crypto market liquidity in several ways:

- Shift in Investor Behavior: Faced with economic uncertainty, investors might reallocate their portfolios, potentially increasing or decreasing their exposure to crypto assets.

- Trading Volumes on Major Exchanges: Historical data shows that during periods of economic policy shifts, trading volumes on crypto exchanges can either spike or drop sharply. A higher volume typically indicates strong market participation, while a drop might signal a flight to safety.

How Tariffs Could Alter Trading Volumes

- Increased Speculative Trading: If tariffs lead to fears of inflation or currency devaluation, some investors may turn to cryptocurrencies, boosting trading volumes.

- Reduced Confidence: Conversely, heightened economic uncertainty might cause investors to liquidate positions, leading to lower liquidity and increased price volatility.

Investor Sentiment and Risk Appetite

Investor sentiment is a critical driver in the crypto market. Tariffs contribute to uncertainty in several ways:

- Risk-Averse Behavior: Political and economic uncertainties often cause investors to become risk-averse, moving their capital into safer assets such as gold, government bonds, or even cash.

- Crypto as a Safe Haven? While cryptocurrencies are sometimes touted as a hedge against traditional market risks, their inherent volatility may cause investors to view them as risky during times of crisis.

Discussion on Whether Crypto is Seen as a Safe Haven or a Risky Asset

The perception of crypto assets as safe havens is not uniform:

- Safe-Haven Narrative: In some cases, cryptocurrencies like Bitcoin are seen as a digital gold alternative. However, the correlation between crypto and traditional safe-haven assets is complex and not always consistent.

- Risk Asset Perspective: More often, the crypto market is categorized as high-risk, with prices subject to significant swings driven by investor sentiment, regulatory news, and market liquidity.

Institutional and Retail Investor Impact

Institutional investors play an increasingly important role in the crypto market:

- Reallocation of Portfolios: In times of economic uncertainty, institutional investors may shift their holdings from riskier assets like cryptocurrencies to more stable investments. However, if tariffs result in a significant devaluation of fiat currencies, they might see crypto as an alternative store of value.

- Long-Term vs. Short-Term Strategies: Institutional strategies tend to focus on long-term fundamentals. If tariffs lead to prolonged economic instability, institutions might reduce their crypto exposure until the situation stabilizes.

Retail Sentiment and Media Coverage

Retail investors are more susceptible to news and market sentiment:

- Media Amplification: Negative headlines and continuous media coverage of trade wars and tariffs can exacerbate fears among retail investors, leading to increased sell-offs.

- Herd Behavior: Retail investors often react to market sentiment in a herd-like fashion, potentially amplifying volatility during periods of uncertainty.

Economic and Political Factors at Play

Tariffs can have wide-reaching effects on a country’s economy:

- Inflationary Pressures: Tariffs increase the cost of imported goods, which can lead to higher consumer prices. This, in turn, fuels inflation, eroding the purchasing power of fiat currencies.

- Currency Devaluation: As inflation rises, central banks might intervene by adjusting interest rates, potentially leading to a devaluation of the national currency. A weaker currency can make cryptocurrencies more attractive as a store of value.

Overall Economic Growth

- Slowing Economic Growth: Tariffs often disrupt international trade and can lead to slower economic growth. Reduced economic activity can negatively affect investor confidence, prompting a shift away from risk assets.

- Impact on Corporate Earnings: Companies facing higher input costs may see their profit margins shrink, which can lead to broader market corrections in equities and other asset classes.

Political Uncertainty

Political uncertainty remains a significant driver of market behavior:

- Geopolitical Tensions: Ongoing trade disputes, particularly those involving major economies like the U.S. and China, create an environment of uncertainty that can spill over into the crypto market.

- Policy Volatility: Unpredictable policy changes or shifts in trade agreements can lead to rapid changes in market sentiment. Investors may become cautious, reducing exposure to riskier assets like cryptocurrencies.

Influence of Regulatory Debates Spurred by Tariff Policies

- Regulatory Scrutiny: Tariffs often trigger debates about the adequacy of regulatory frameworks, particularly in emerging sectors like crypto. Increased scrutiny may result in stricter regulations that can stifle innovation.

- Investor Confidence: The lack of clarity regarding future regulatory actions can deter investment, leading to lower market liquidity and increased volatility.

Global Trade Dynamics

Tariffs disrupt global trade in significant ways:

- Supply Chain Disruptions: Higher tariffs can force companies to restructure their supply chains, leading to inefficiencies and increased costs.

- Trade Imbalances: Tariffs aim to rebalance trade, but they can also lead to retaliatory measures from trade partners, further destabilizing global markets.

Spillover Effects on International Economic Stability

- Investor Flight to Safety: Economic instability on a global scale can lead to a flight of capital into traditionally safer assets. If crypto assets are not viewed as safe havens, they may suffer as a result.

- Impact on Emerging Markets: Tariffs can have an outsized impact on emerging markets, which often serve as growth engines for the global economy. Reduced growth in these markets can lead to lower overall demand for risk assets, including cryptocurrencies.

Technical Analysis and Historical Context

Chart Patterns and Price Action

Analyzing recent price charts can provide insights into how tariffs might affect crypto:

- Support and Resistance Levels: Identifying key support and resistance levels on Bitcoin and other major cryptocurrencies can help determine potential price movements. Historically, political and economic uncertainty tends to push prices toward established support zones.

- Price Volatility: Chart patterns indicate increased volatility during periods of geopolitical tension. Look for trends such as lower highs and lower lows, which suggest a bearish market sentiment.

Historical Comparisons

Previous geopolitical and trade-related events provide a useful context:

- Historical Downturns: In past episodes of economic policy shifts, cryptocurrencies have experienced significant downturns. However, these were often followed by recoveries as markets adjusted to new realities.

- Market Resilience: Despite volatility, the long-term trend in crypto markets tends to be upward. Analyzing past market cycles can help set expectations for potential recovery periods following tariff-induced corrections.

Technical Indicators

Key technical indicators provide quantitative measures of market momentum:

- Moving Averages: The convergence or divergence of short-term and long-term moving averages (e.g., 50-day vs. 200-day) can signal shifts in market sentiment.

- Relative Strength Index (RSI): An RSI value in the overbought or oversold range can indicate whether a market is primed for a reversal.

- MACD Analysis: The Moving Average Convergence Divergence indicator helps in identifying changes in momentum. A bearish MACD crossover may confirm the negative impact of tariffs on the market.

Insights on Future Movements

By combining these technical indicators with historical trends, analysts can forecast potential price movements under different tariff scenarios. A technical correction following increased volatility is common during periods of high uncertainty.

Scenario Analysis: Potential Outcomes

- Fiat Currency Devaluation: If tariffs lead to a significant devaluation of fiat currencies, investors may flock to cryptocurrencies as a hedge against inflation. This scenario could drive up demand for digital assets.

- Increased Demand for Alternatives: With traditional assets under pressure, crypto markets might benefit from a reallocation of capital, resulting in a robust recovery.

Expected Market Behavior

- Steady Growth: In an optimistic scenario, trading volumes would remain high, liquidity would improve, and technical indicators would eventually shift toward bullish patterns.

- Rising Institutional Interest: Clear signals of fiat currency devaluation and robust crypto adoption could attract institutional investors, further fueling the upward trend.

Pessimistic Scenario

Conditions Leading to a Broader Economic Downturn

- Economic Slowdown: If tariffs trigger a significant economic slowdown, investor risk appetite might diminish. This could lead to a mass exodus from risk assets, including cryptocurrencies.

- Regulatory Clampdowns: Heightened regulatory scrutiny in response to economic instability might stifle innovation and lead to a prolonged market correction.

Expected Market Behavior

- Reduced Liquidity: Lower trading volumes and increased volatility would likely characterize a pessimistic scenario. Investor confidence would be low, and technical indicators might signal a downward trend.

- Institutional Withdrawal: With economic uncertainty high, institutional investors might reduce their exposure to cryptocurrencies, exacerbating the market downturn.

Neutral/Mixed Scenario

- Conflicting Economic Indicators: A scenario where economic indicators provide mixed signals can lead to a cyclical, sideways market. Investors might oscillate between cautious optimism and fear, leading to high volatility.

- Balanced Policy Impact: If tariff impacts are balanced by other economic stimuli, the market might not see a clear directional move, instead experiencing periods of rapid gains and corrections.

Expected Market Behavior

- Sideways Trading: A neutral scenario would likely see the market oscillating within a defined range, with no significant long-term directional movement.

- Heightened Volatility: Despite the lack of a clear trend, market volatility would remain high as investors react to ongoing political and economic news.

Catalyst Events to Watch

- Elections and Policy Announcements: Key political events, such as elections or major policy announcements, could tip the balance toward any of the scenarios.

- Trade Negotiations: Progress in international trade negotiations or the resolution of trade wars can provide the necessary catalyst for a market shift.

Regulatory Announcements

- New Regulations: Announcements regarding crypto-specific regulations or broader economic policies can have immediate impacts on market sentiment.

- Global Economic Data: Releases of key economic data (e.g., inflation reports, GDP growth figures) will also be crucial in determining the market’s direction.

Community Sentiment and Media Reaction

- Community Sentiment: Analysis of posts and discussions on social media platforms like X.com reveals how crypto communities are reacting to news about tariffs. Positive sentiment may drive bullish trends, while negative sentiment can amplify sell-offs.

- Engagement Metrics: High engagement rates (likes, retweets, comments) indicate that the topic is resonating with the community. Monitoring sentiment scores can provide early warning signals of market shifts.

Influencer and Analyst Opinions

- Crypto Influencers: Leading crypto influencers have been vocal about the potential impacts of tariffs on digital assets. Their commentary can sway investor sentiment and sometimes set market trends.

- Expert Analysis: Financial experts and market analysts provide a range of opinions—some see tariffs as an opportunity for crypto, while others warn of significant risks. These diverse viewpoints help shape a balanced perspective.

Media Coverage Impact

- Amplification of News: The way media covers tariff-related news can have an outsized impact on market sentiment. Sensational headlines may trigger panic selling, while balanced reporting can stabilize investor outlook.

- Case Studies: Historical examples of media-induced volatility show that consistent, measured reporting tends to have a more stabilizing effect on markets than sporadic, dramatic headlines.

References and Further Reading

- International Monetary Fund (IMF) – Global Economic Outlook: https://www.imf.org

- World Bank – Global Economic Prospects: https://www.worldbank.org

- Federal Reserve – Monetary Policy Reports: https://www.federalreserve.gov

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with professional advisors before making any investment decisions.