Brett (Based) is trading near its all-time low at approximately $0.03174, a level that aligns with a major support zone dating back to earlier price structures. After reaching an all-time high of around $0.23 on December 1st, 2024, the coin has trended consistently downward, indicating a sustained bearish sentiment. The live price today stands at $0.032201, with a 24-hour trading volume of $25,524,159, reflecting a 6.08% decrease in value over the same period. Ranked #136 on CoinMarketCap, Brett has a market cap of $319,123,051, a circulating supply of 9,910,236,395 BRETT coins, and a maximum supply of 10,000,000,000 BRETT coins.

Chart Overview and Price Action

Brett has formed a pronounced downward channel since its peak of $0.23. Price action remains confined within descending trendlines, making lower highs and lower lows. This pattern signifies persistent selling pressure. Sellers appear to dominate, and any short-lived bounce has yet to break the upper boundary of the channel. Until Brett breaks above this descending resistance, the overall momentum remains bearish.

Major Support and Resistance Levels

The coin’s current support is around $0.03174, which is very close to its historical lows. This zone has attracted buyers in the past, providing a potential floor. A break below this level could open the door to uncharted territory, possibly leading to new all-time lows. On the upside, the first key resistance lies near $0.045–$0.05, an area that would need to be reclaimed for bulls to gain meaningful traction.

Volume and Volatility

Daily trading volume stands at $25,524,159, a respectable figure for a mid-cap token. However, volume trends have been inconsistent, suggesting that market participants may be hesitant to commit large capital in either direction. Sudden spikes in volume near the support level could signal a potential reversal if buyers decisively step in.

On-Chain Data Analysis

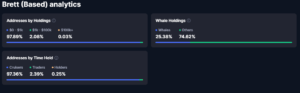

Addresses by Holdings

Current data shows that 97.89% of addresses hold between $0–$1,000 worth of BRETT, 2.08% hold between $1,000–$100,000, and only 0.03% hold over $100,000. This distribution implies that the majority of participants are small-scale holders, which can mean limited market-moving power from retail investors. The smaller percentage of mid-level holders could indicate a lack of significant accumulation by mid-tier traders. Meanwhile, the extremely small fraction of large holders may reflect either a cautious approach from big investors or a project still seeking institutional or whale-level backing.

Whale Holdings

Despite the seemingly small number of addresses with large balances, whales collectively control 25.38% of the circulating supply, while other holders account for 74.62%. A few high-value wallets thus have a substantial influence over the market. If these whales decide to sell, the price could face additional downward pressure. Conversely, if whales begin accumulating or holding long-term, they could stabilize the market by removing supply from circulation.

Addresses by Time Held

On-chain analytics also reveal that 97.36% of addresses are classified as “Cruisers,” 2.39% as “Traders,” and 0.25% as “Holders.” Cruisers typically hold coins for a moderate time frame, often waiting for favorable market conditions. Traders generally move in and out of positions quickly, contributing to short-term volatility. Long-term holders, though a tiny percentage, might provide a stable base if they continue to hold through market fluctuations. A large cruiser base suggests that many participants are waiting for a price recovery, but if impatience sets in, the market could see an influx of selling pressure.

Bull Case

The most compelling argument for the bulls lies in the strong support at $0.03174. This level has historical significance and could act as a springboard if buyers defend it aggressively. A successful retest with rising volume might trigger a short-covering rally, especially if the broader crypto market stabilizes or turns bullish.

Whale Accumulation and Community Engagement

If whales continue to hold or add to their positions, their buying activity could limit the coin’s downside. A stable or rising whale percentage typically signals confidence among large investors. Additionally, if the community remains active on social media and engages in promotional campaigns, renewed interest could attract fresh capital, fueling a potential rebound.

Bear Case

Brett’s price action indicates that bears are still in control, with the coin unable to break out of its descending channel. A definitive close below $0.03174 would likely confirm a new leg down, potentially creating fresh all-time lows. This scenario would erode market confidence, leading to further capitulation among retail and mid-tier holders.

Negative Market Sentiment and Whale Sell-Off

Market-wide sentiment remains a pivotal factor. If overall crypto sentiment continues to weaken or if macroeconomic conditions deteriorate, smaller altcoins like Brett can see accelerated declines. Any signs of whales offloading positions would amplify panic selling, intensifying downward pressure. The risk of large sell orders is especially pronounced when a handful of addresses control a significant share of the supply.

Final Words

Brett (Based) sits at a crucial juncture, with its price hovering near historic lows. Technical indicators and the prevailing downward trend suggest caution, as breaking below $0.03174 could result in further downside. However, if buyers defend this support zone and whales show continued commitment to holding or accumulating, Brett may see a relief rally. The distribution of addresses by holdings and time held underscores the coin’s vulnerability to sudden shifts in sentiment, particularly from high-capital investors. In the end, the battle between bulls and bears will hinge on volume, whale activity, and broader market conditions. Traders and long-term investors alike should monitor on-chain data and price action closely to gauge Brett’s next significant move.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Always conduct thorough research and consult with financial professionals before making investment decisions.