The U.S. Bitcoin mining industry, once a global leader, now faces a dual threat that could significantly alter its trajectory. Recent policy proposals, including steep tariffs and a substantial tax on electricity usage, have miners and investors expressing deep concern over the industry’s sustainability within American borders.

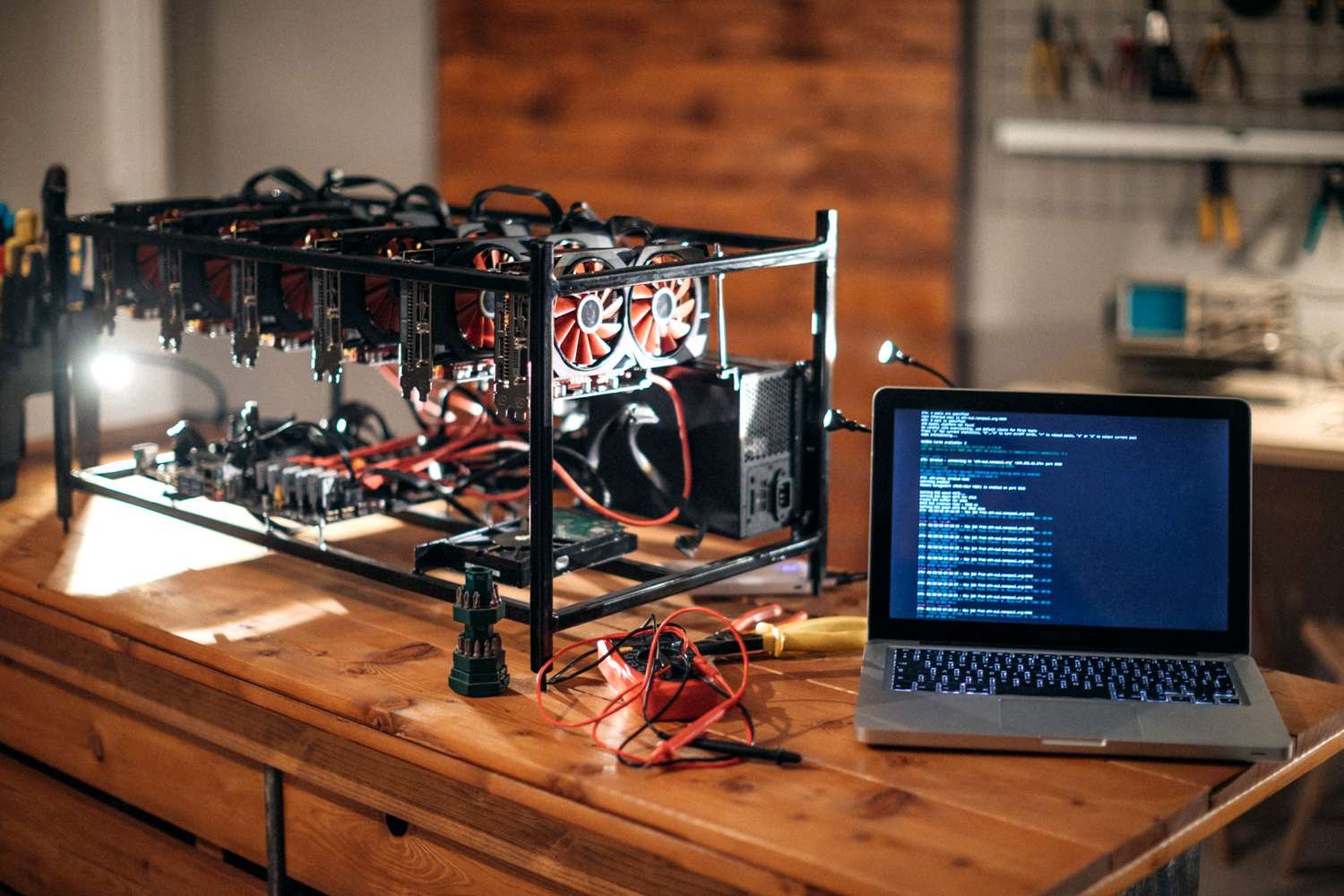

Tariffs on Mining Equipment Raise Operational Costs

In an unexpected move, the U.S. government has introduced tariffs as high as 36% on imported cryptocurrency mining equipment. This policy shift aims to protect domestic manufacturing but has inadvertently placed a heavy financial burden on Bitcoin miners who rely on specialized hardware predominantly produced overseas.

The immediate impact has been a surge in operational costs for mining companies. Firms like Marathon Digital Holdings and Riot Platforms have reported significant increases in expenses, leading to a reevaluation of their business models. The higher costs not only affect profitability but also hinder the industry’s ability to expand and innovate.

Proposed 30% Tax on Electricity Usage Intensifies Pressure

Compounding the challenges posed by tariffs, the Biden administration has proposed a 30% excise tax on the electricity consumed by cryptocurrency mining operations.

This measure, part of the broader Digital Asset Mining Energy (DAME) tax initiative, is intended to address environmental concerns associated with high energy consumption in the crypto mining sector.

Industry leaders argue that this tax could be detrimental to the U.S. mining landscape. Critics contend that the policy may drive mining operations to relocate to countries with more favorable regulatory environments, potentially leading to job losses and decreased technological investment domestically.

Furthermore, there is skepticism about the tax’s effectiveness in achieving its environmental objectives, as displaced operations might move to regions with less stringent environmental regulations, potentially increasing the global carbon footprint.

Industry Response and Potential Relocation

The combined effect of increased tariffs and the proposed electricity tax has prompted a strong response from the cryptocurrency mining community.

Many companies are exploring the possibility of relocating their operations to countries with more supportive policies. Nations such as Canada, Kazakhstan, and certain European countries are being considered due to their favorable regulatory climates and access to renewable energy sources.

This potential exodus raises concerns about the U.S. losing its competitive edge in the rapidly evolving cryptocurrency sector.

The departure of mining operations could result in a loss of technological expertise, reduced investment in infrastructure, and diminished influence over the global digital currency landscape.

Economic and Environmental Implications

The economic implications of these policy changes are significant. Increased operational costs may lead to higher transaction fees for Bitcoin users and could slow down the adoption of blockchain technologies.

Additionally, the potential relocation of mining operations might result in job losses and decreased economic activity in regions that have benefited from the industry’s growth.

From an environmental perspective, the proposed electricity tax aims to reduce the carbon footprint of cryptocurrency mining.

However, experts caution that if operations move to countries with less stringent environmental regulations, the global environmental impact could worsen. Ensuring that mining activities utilize renewable energy sources remains a critical component of sustainable growth in the sector.

Final Words

The U.S. Bitcoin mining industry stands at a crossroads, facing significant challenges from newly imposed tariffs and proposed taxation policies. The decisions made in the coming months will likely determine the future of cryptocurrency mining within the United States and its position in the global digital economy. Stakeholders continue to advocate for balanced policies that address environmental concerns without stifling innovation and economic growth.